Describe the role and importance of a regulator in ensuring fair and transparent financial markets.

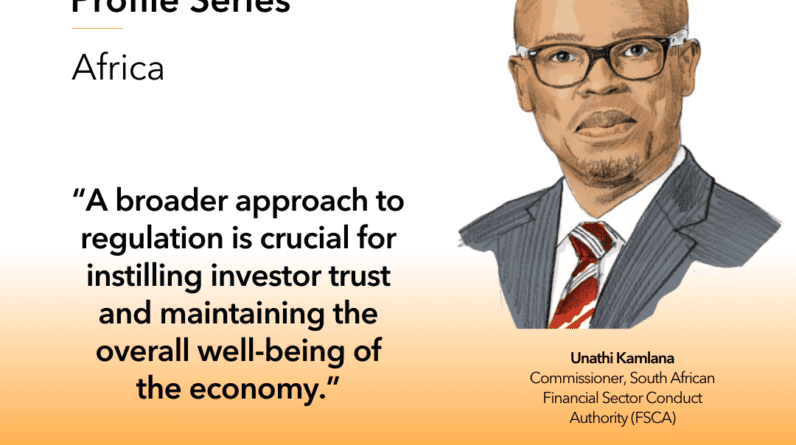

Regulation in financial markets is necessitated by the role information plays in financial market functioning. The inherent information asymmetry between various role players and their customers requires an independent party to promote a more fair and transparent distribution of information to reduce the potential for harmful practices which would otherwise exist in the absence of regulation. Without this, only those with substantial means would have access to all the information – although that would still be profitable, it would not be sustainable. As such, the role of regulators includes enforcing rules to prevent market abuse, insider trading, ensuring transparency, and proper disclosure, in financial markets. This role has evolved to include creating an environment that enables adaptable markets in the face of present and future challenges. This broader approach to regulation is crucial for instilling investor trust and maintaining the overall well-being of the economy.

In an ideal world, how would you shape global standards to ensure frontier, emerging, and developed markets have an equal voice?

Given the broader impact of global standards, which goes beyond the remit of large economies and mostly advanced countries, what is needed is the establishment of more inclusive platforms where we can harness the benefits of a diversity of perspectives and views and a better understanding and appreciation of the different starting points of every country, regardless of its economic size or level of global influence. That is a better way of fostering a race to the top in terms of the adoption of global standards.

What are the key emerging regulatory trends and how are you as an organization addressing these new risks to remain effective?

Emerging regulatory trends confronting us include the increase of digitization, rising adoption of blockchain technology, cybersecurity risks and the incorporation of Environmental, Social, and Governance (ESG) considerations in investment decisions across the economy. These trends have necessitated that we adopt a more proactive approach to supervision and a flexible approach to regulation, are investing in supervisory technologies, strengthening our cybersecurity frameworks, and developing guidelines for sustainable finance. These measures are aimed at protecting consumers, maintaining market integrity, and fostering innovation, ensuring that our regulatory framework stays robust and responsive to changing market dynamics.

What does the future of financial services in Africa look like?

We expect the increase in the digitalization of finance (including fintech), the adoption of platform business models by financial services players, sustainable and open finance to remain the key themes in terms of the outlook for financial services in Africa. AI will also revolutionise the provision of financial services and advice with significant implications for conduct and fair customer outcomes

Overall, these shifts should result in improvements in terms of financial inclusion across the continent, ensuring that many more people have access to basic financial services and/or higher levels of utilization of existing nodes of financial services. This should be positive for growth and development. The financial services space is also ripe for further innovation – which will require continuous improvements in terms of regulatory approaches which are better calibrated to support and anchor responsible innovation in the financial sector.

This profile forms part of Bloomberg’s Regulatory Affairs insights series and is independent of Bloomberg News.