Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan, is investing $80 million in Perfios, an Indian fintech that provides real-time credit underwriting solutions to banks and other financial institutions. The new investment values Perfios at a valuation of over $1 billion.

15-year-old Perfios, which raised a $229 million funding round in September, said it will use the fresh capital for international expansion and to explore inorganic growth opportunities (read acquisitions.) The startup, which has raised $464 million in primary and secondary transactions to date, plans to go public by next year, it said earlier.

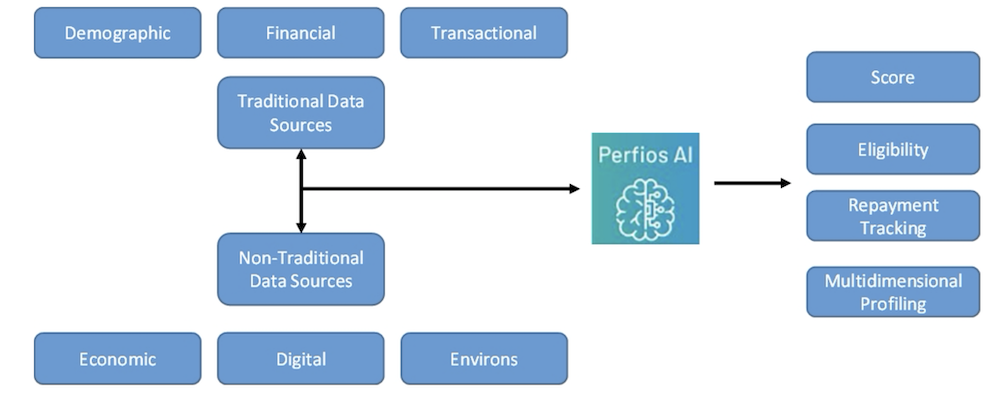

Bengaluru-based Perfios provides real-time data aggregation and analysis tools to financial institutions, enabling them to streamline their customer journeys and make more informed decisions. By leveraging advanced algorithms, Perfios helps banks, fintechs and other financial institutions as well as insurance firms reduce risk, spot fraud, and improve the overall quality of their portfolios while strengthening their decision making processes.

“Our business has been seeing steady growth year-on-year, with consistent improvement in the bottom line,” said Sabyasachi Goswami, CEO of Perfios, in a statement. “I want to extend my heartfelt gratitude to all our partners who have trusted us throughout our journey.”

Perfios said it delivers 8.2 billion data points to banks and other financial institutions every year to facilitate faster decisioning, and processes 1.7 billion transactions a year with an AUM of $36 billion. Perfios is the second unicorn from India this year.

Perfios’ credit decisioning tools. Image Credits: AllianceBernstein

“We are excited about the growing opportunities within the B2B enterprise tech space in India, and we believe Perfios is a best-in-class fintech-focused SaaS player,” said Kelvin Yu, Senior Managing Director and Head of Teachers’ Venture Growth in Asia, in a statement.

Ontario Teachers’ Pension Plan, one of Canada’s largest pension funds, has ramped up its interest in India in recent years. The fund, which also backed logistics unicorn Xpressbees last year, has invested more than $3 billion in India and plans to deploy a significant amount in the country by 2030 as part of its broader goal to deploy $300 billion in certain key markets.