All small business owners know that the key to success is planning. A solid SMB strategy means projecting labor needs and labor costs ahead of time, so you have a clear budget and know when you’ll need to pull in more revenue to cover your expenses.

One major factor in controlling labor costs is properly implementing minimum wage laws. However, Michigan’s minimum wage is constantly changing — leaving businesses scrambling to keep up.

Right now, the Michigan minimum wage is increasing every year, on a set schedule, in line with the Improved Workforce Opportunity Wage Act.* But things may change. There are lawsuits happening right now looking to adapt the wage rate and timetable currently set. What’s more, the wage-increase schedule is tied to Michigan’s unemployment rate — so if unemployment is high, planned increases may not happen.

It’s a lot to keep up with — which is why we wrote this article to make things clear. We’ll explain everything Michigan small business owners need to know about the state’s current minimum wage laws and upcoming changes, so you can plan ahead and stay compliant.

*Improved Workforce Opportunity Wage Act, 2018

Minimum wage in Michigan: Everything you need to know

Whether you run a restaurant in Ann Arbor, a boutique in Traverse City, or an agency in Detroit, this guide has you covered. We’ll go through all the key information so you can feel confident you’re complying with minimum wage regulations — and get ready for proposed increases.

Michigan’s current minimum wage rate

As of January 1, 2024, Michigan’s current minimum wage is $10.33 per hour, increased from $10.10 in 2023. This applies to most non-tipped workers.

“Tipped workers” are employees who regularly receive gratuities, like bar staff, servers, and hairdressers. Michigan minimum wage in 2024 for tipped workers is $3.93. However, business owners need to make sure that the base wage plus gratuities add up to at least the standard minimum wage of $10.33. If the total is less than that, the employer must make up the shortfall.

Exceptions to minimum wage

Under Michigan law, minimum wage rules apply to all adult workers 18 years or older, employed by a business that has two or more employees.

However, minors who are 16–17 years old can be paid 85% of the current minimum wage, which works out at $8.78 for 2024.

Employers can also pay a lower training wage of $4.25 per hour to newly-hired employees aged between 16–19 for their first 90 days.

5 steps to sure your small business complies with Michigan’s minimum wage requirements

Keeping up with minimum wage compliance regulations might seem overwhelming. We’ve broken it down into 5 key steps you can follow to feel confident you’re not missing anything.

Step 1: Update payroll systems, compensation models, and starting employee agreements to make sure they comply with the current minimum wage. Tools like Homebase can automate this process for you, so you can feel confident your calculations are compliant.

Step 2: Print and display updated workplace posters whenever minimum wages shift. This will make sure your people know the current wage laws. Keep digital copies as well for your records.

Step 3: Prepare for changes to your overtime pay and policy. You’ll need to pay staff members who work more than 40 hours in a single week 1.5 times their regular hourly rate. That means overtime costs increase in line with the minimum wage — overtime minimum wage in 2024 works out at $15.49 per extra hour worked.

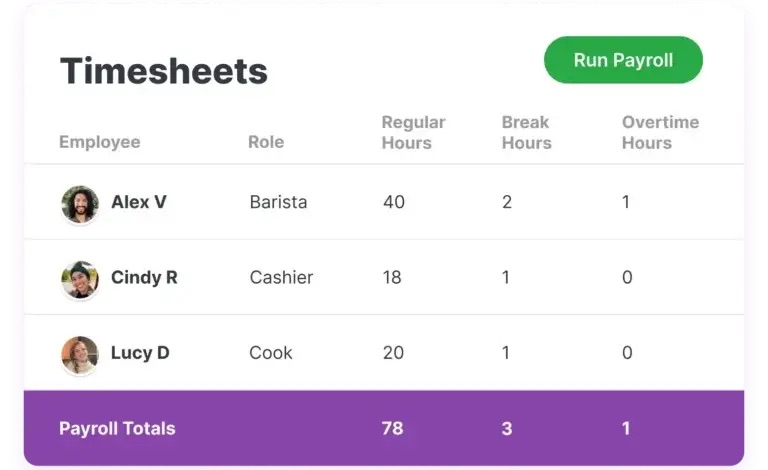

As well as making sure you pay overtime correctly, you’ll want to consider how increased overtime rates affect your labor cost budget. You may want to cut down on unplanned overtime, which is where Homebase’s time clock can come in handy, to alert you when employees are about to go into overtime based on their hours worked.

You’ll also want to check for exceptions to overtime policy, to see if you’re covered. For example, agricultural workers and workers at amusement parks and other recreational businesses open less than 7 months of the year are exempt.

Step 4: Make sure your recordkeeping is solid. If you’re audited, you’ll need to be able to show records of hours worked, overtime, tips collected, and even proof of age, if you’re paying a reduced wage to those under 18. This is where dedicated payroll software can save you a lot of time and energy.

Step 5: Stay up to date with Michigan labor laws. It’s especially important for small business owners in Michigan to stay on top of the minimum wage rate because they could change even more than expected in 2024 based on the results of several legal appeals looking to reverse amendments to the Improved Workforce Opportunity Wage Act.

Regularly check the Bureau of Employment Relations webpage, where they’ll post any updates based on the courts’ decisions.

Effortless minimum wage compliance for SMBs

Updating old systems and paperwork whenever Michigan drops new minimum wage rules creates headaches for smaller companies.

Dedicated small-business-friendly software like Homebase can do the heavy lifting for you.

Homebase can help you:

Adapt payroll to your state’s current wage laws in just a few clicks

Feel confident you have detailed payroll records available anytime

Track overtime with automated time clocks that integrate with payroll functions

Access expert HR guidance to make sure you’re compliant with labor laws

Make smart employee scheduling decisions based on changing minimum wage rates

Convey important announcements, whether about minimum wage or other topics, with a team communication app

We give SMB owners the tools to manage payroll, compliance, and scheduling, stress-free, so they can focus on realizing their small business dreams.