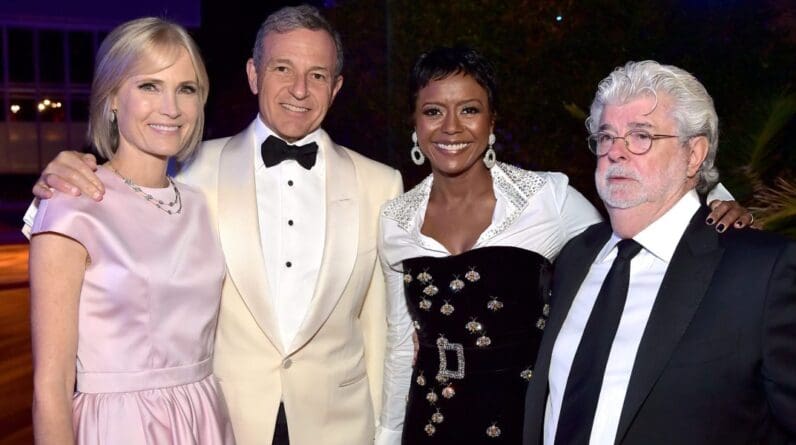

Question: Who do the Star Wars creator George Lucas and JPMorgan Chase’s star CEO and chairman Jamie Dimon have in common?

Answer: Ariel Investments co-CEO Mellody Hobson, also one of Fortune’s most powerful women.

Hobson was the first Black woman to join JPMorgan’s board, in 2018, and has served as co-CEO of Chicago-headquartered investment firm Ariel Investments, which has nearly $15 billion in assets under management, since 2019. Hobson married Lucas in 2013 at Skywalker Ranch.

Lucas issued a statement from the ranch today, outlining his support for Walt Disney CEO Bob Iger in Disney’s proxy fight with activist investor Nelson Peltz. Iger and Peltz have been embroiled in a battle for board seats at the entertainment giant, with Peltz aiming to get himself and a deputy on the board while Disney plays defense. Lucas owns 37.1 million shares of Disney after selling Lucasfilm to the company in 2012 for $4 billion in cash and stock.

Lucas’ encouragement from Skywalker Ranch comes on the heels of Dimon’s full-throated support for Iger last week.

“Bob is a first-class executive and outstanding leader who I’ve known for decades,” Dimon said. “He knows the media and entertainment business cold and has the successful track record to prove it.”

“When Bob recently returned to the company during a difficult time, I was relieved,” said Lucas today. “No one knows Disney better.”

After Lucas and Hobson wed at the Skywalker Ranch ceremony in 2013, the couple also held a party in Promontory Park in Chicago, according to Vogue. Prince performed live with a 22-piece orchestra and at one point pulled Hobson onstage. One of the guests reported to be at the party was former Chicagoan Dimon. Dimon is former CEO of Chicago-based Bank One, which merged with JPMorgan in 2004. Dimon was tapped to lead the now $3.2 trillion financial services firm.

In addition to Lucas and Dimon, proxy advisory firm Glass Lewis issued its report to investors this week and threw its support behind Iger and the Disney board, recommending that investors withhold support from Peltz and his deputy and nominees from another activist fund, Blackwells.

Voting in the contest has already begun and losing the support of Glass Lewis is a key loss for Peltz and a win for Iger and Disney. The company’s shareholder meeting is April 3.