This article was written by Steve Hou, PhD, Co-Head of Equity Research at Bloomberg Indices.

Today’s global economic landscape is marked by geopolitical turbulence, notably the Russian invasion of Ukraine in 2022 and the escalating tensions between the United States and China. This complex geopolitical environment necessitates a thorough evaluation of the new risks associated with investing internationally, particularly in emerging markets. Investors are increasingly cautious about the uncertainties arising from politically unstable environments, especially in countries with non-democratic regimes.

Explore our index families.

Despite these challenges, the potential rewards of investing in emerging market (EM) equities make them an attractive option for investors willing to navigate the geopolitical risks. Because EM equities have underperformed US equities for over a decade, it’s easy to forget that EM equities strongly outperformed US equities in the 2000s [Figure 1]. Today, EM equities offer their most attractive prospects in two decades, with the PE ratio of the EM index relative to the US Large Cap Index (B500 Index) reaching a low in 2022, not seen since 2004. Moreover, the ongoing restructuring of global supply chains through near-shoring or friend-shoring is unlocking significant economic opportunities for companies based in EM countries that are considered more reliable partners by the US and other advanced Western economies.

Considering both risks and opportunities, Bloomberg has introduced a novel emerging markets index: the Bloomberg Emerging Market Democracies Index (BFREE Index). Leveraging a comprehensive dataset from Freedom House, the BFREE Index offers investors access to stocks from countries classified as electoral democracies. Using the BFREE index as an example, this article outlines the risk and returns of investing in democracies, as an alternative to conventional EM indices (details of the BFREE index construction can be found here).

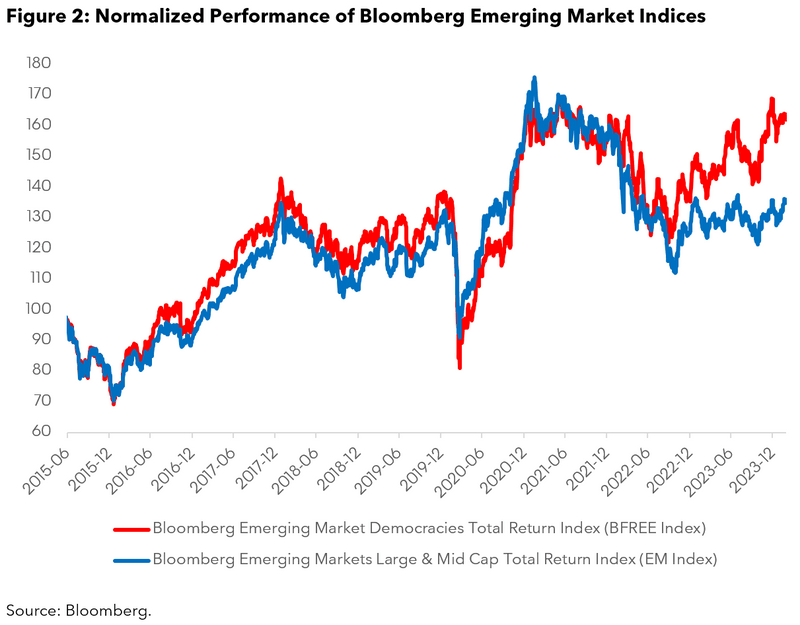

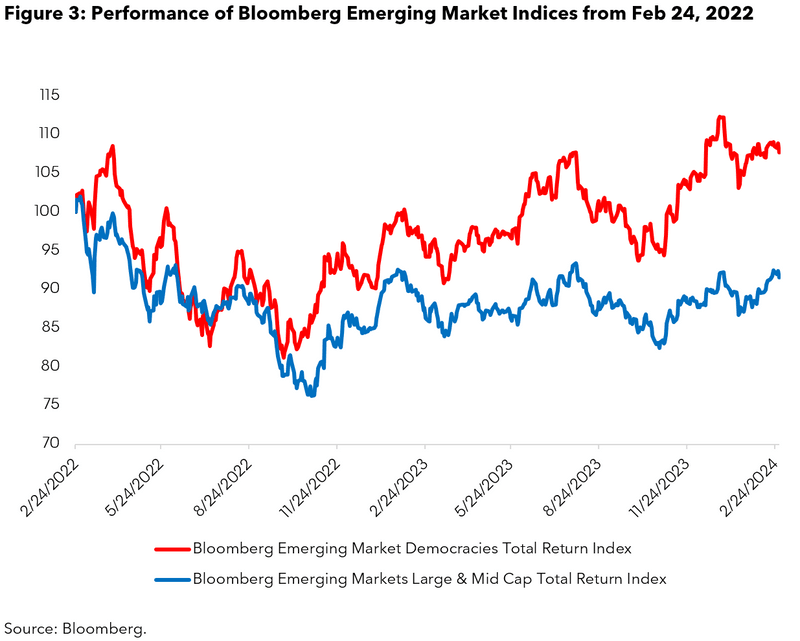

BFREE index has outperformed vanilla EM index in recent years

Since April 20, 2015, the BFREE Index has consistently surpassed the conventional Bloomberg EM index by up to 40% in cumulative total returns. This outperformance has been notably pronounced over the last two years. Since Feb 24, 2022, or the start of the Russian invasion of Ukraine, the BFREE Index has outperformed the EM Index by 16%. Whereas the EM index encountered a significant drawdown in 2022, from which it has yet to fully rebound, the BFREE Index experienced a milder downturn and displayed a robust recovery.

Explaining outperformance

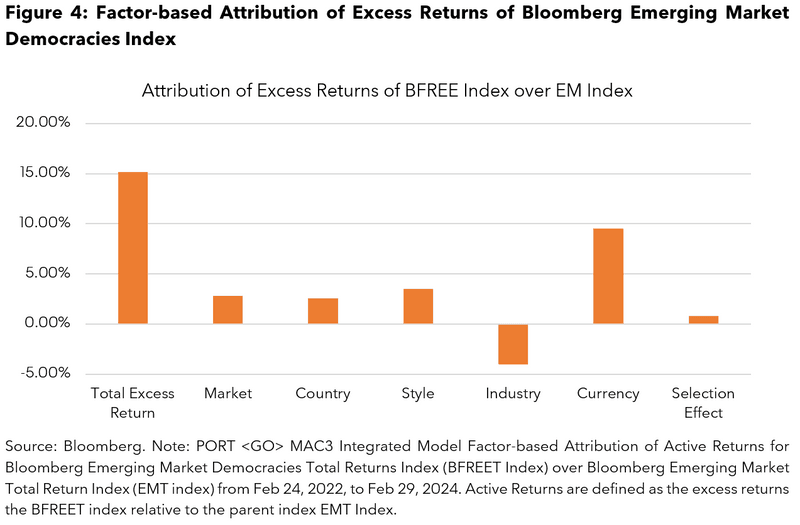

What factors contribute to the outperformance of the BFREE Index? Are there underlying and enduring reasons for this superiority? Given that the BFREE index construction has no explicit style or industry factor screens (aside from a market cap screen), any active factor exposures are arguably the result of exposure to the democracy factor. What are the risks and benefits associated with the democracy factor? To address these questions, let’s utilize Bloomberg’s MAC 3 equity risk model to decompose excess returns generated by the BFREE index.

In Figure 4, the cumulative excess returns of the BFREE Index over the EM Index are broken down into the equity factor components. From Feb 24, 2022, to Feb 28, 2024, about two-thirds of the BFREE Index’s excess returns can be attributed to advantageous currency exposures. This includes underweighting (or avoidance) of China and overweighting positions in Mexico and Brazil. Notably, Mexico and Brazil are electoral democracies, whereas China is famously not.

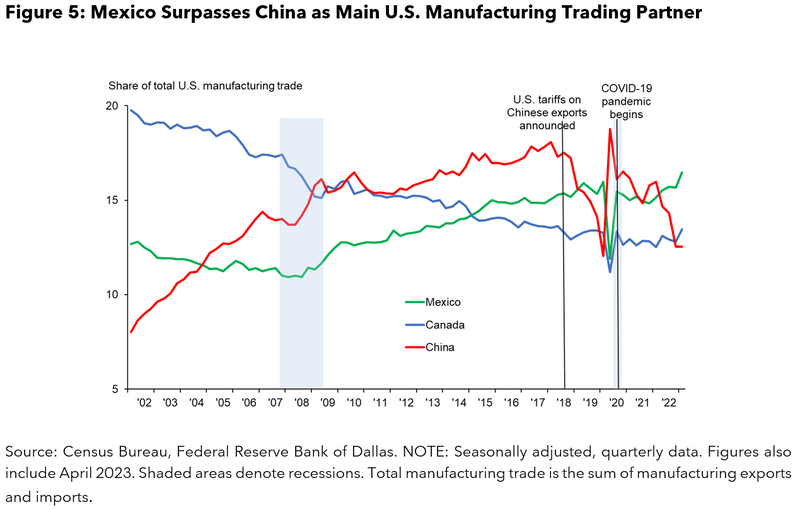

As depicted in Figure 5, Mexico has experienced economic advantages stemming from the US-China decoupling. The country has increasingly emerged as an appealing manufacturing destination, particularly under the USMCA agreement and amid US tariffs on Chinese exports. According to US Census data, Mexico surpassed China in 2022 to become the leading manufacturing trading partner of the US.

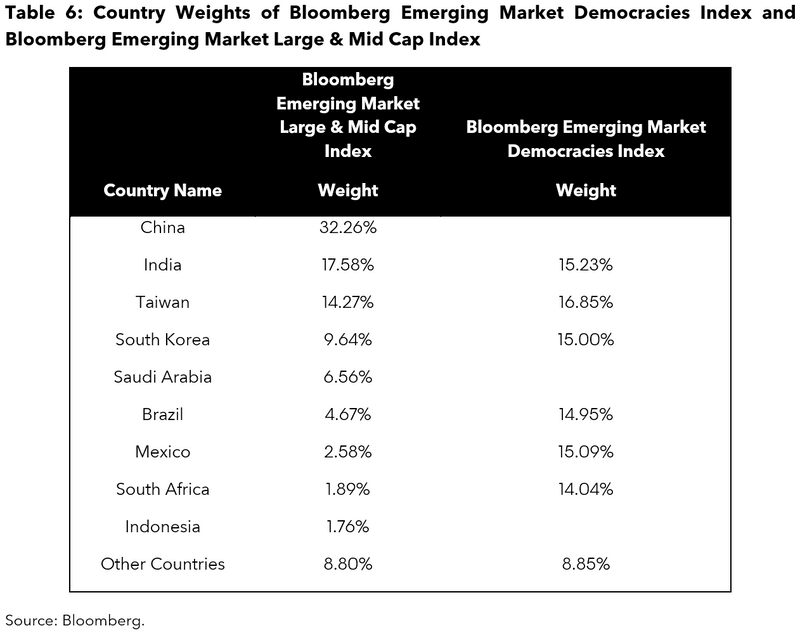

Looking ahead, as shown in Table 6, the BFREE index is overweight India, South Korea, and Taiwan. Consequently, the active exposures to democracies are strategically positioned to capitalize on the new drivers of global growth, including the ongoing shift of manufacturing supply chains away from China and the escalating demand for high-performance computing propelled by advancements in artificial intelligence.

BFREE index constituents have more favorable factor exposures

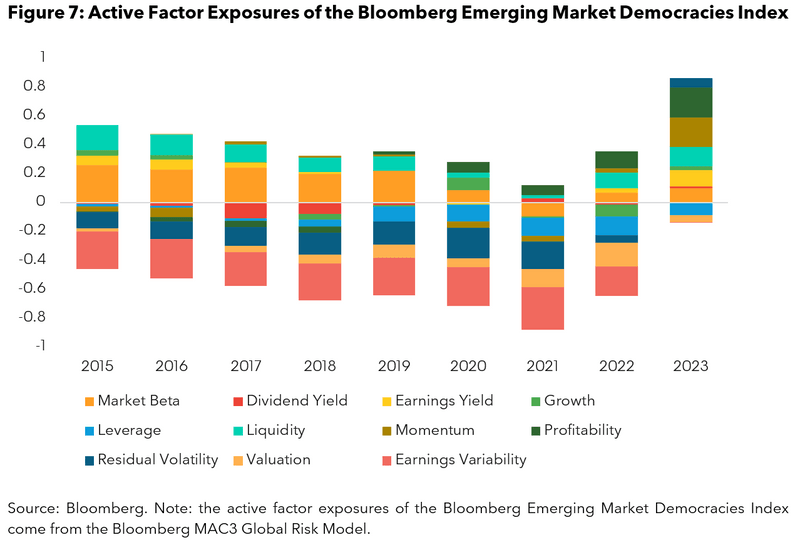

Beyond country exposures, the Bloomberg Emerging Markets Democracies index also has interesting style factor exposures as shown in Figure 7. In general, BFREE index exhibits higher liquidity, slightly higher market beta, and lower financial leverage, lower earnings variability, lower residual volatility, and cheaper valuation. Overall, the BFREE index represents an upward shift in quality. Since 2021, new trends have emerged that the BFREE index also has become more profitable than the broader EM index, exhibited stronger stock price momentum while its active market beta has also decreased.

Put differently, the recent outperformance of the BFREE index is driven less by having larger market beta and more by a blend of advantageous factors: cheaper valuation, higher dividend yield, stronger momentum, and stronger quality (including greater profitability and lower leverage and earnings variability). This combination of style factors has historically been linked with substantial positive risk premiums.

Conclusion

Investing in emerging market democracies can offer investors an alternative approach to capture emerging market opportunities, with macroeconomic and quantitative factors suggesting potential outperformance compared to conventional EM equities. Recent geopolitical shifts favor democratic EM nations, positioning them to capitalize on anticipated structural economic changes. Equities in democracies exhibit favorable style factors that typically entail positive risk premiums, making them an attractive choice for investors seeking to diversify returns.

First Trust has launched the First Trust Emerging Markets Democracies ETF based on the BFREE Index under the ticker EMDM.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.