DBS Group Holdings, Singapore’s largest lender and the largest bank in Southeast Asia by assets, said it achieved a record performance on Wednesday. The bank’s full-year net profits rose 26% to 10.3 billion Singapore dollars ($7.63 billion), beating its target.

Despite the record results, its CEO is getting a pay cut—and the bank’s unreliable digital services are to blame.

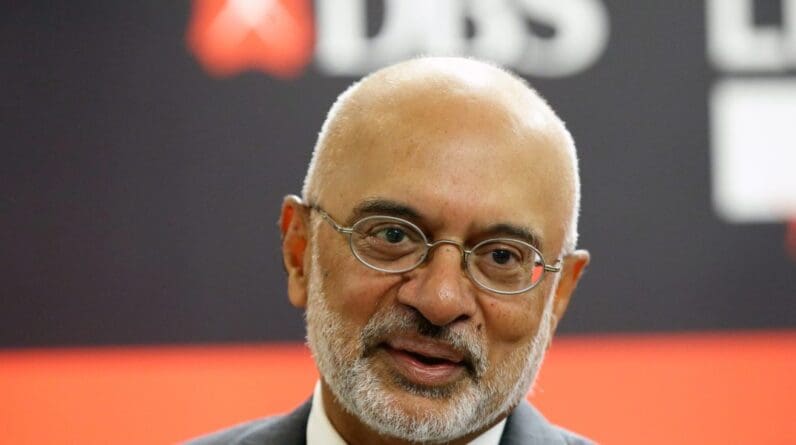

DBS CEO Piyush Gupta took a 30% pay cut to his variable pay, equal to 4.14 million Singapore dollars ($3.08 million). Other members of the management committee took a 21% pay cut. DBS’s board determined that the pay cuts were needed to hold the CEO and other senior managers accountable for disruptions to the company’s digital banking services throughout 2023.

The first major outage happened in March, when some of DBS’s online services went offline for as long as nine hours.

Then in October, a technical issue in an Equinix data center prevented DBS and Citibank customers from accessing banking services. The outage lasted over twelve hours, starting at 2:54pm on Oct. 14. The outage also affected DBS-run automated teller machines, prompting the bank to reopen branches on Saturday afternoon to help customers access their accounts.

In total, DBS faced five major disruptions in 2023. The bank has promised to set aside 80 million Singapore dollars ($59.56 million) to improve system reliability. In November, chairman Peter Seah promised that “senior management will be held accountable, and this will be reflected in their compensation.”

Singaporean authorities weren’t happy with the service interruptions. In November, the Monetary Authority of Singapore, the country’s central bank, barred DBS from acquiring new business ventures for six months. The MAS also ordered DBS to pause non-essential IT changes for six months. The central bank imposed its order to “ensure the bank dedicates the needed resources and attention to strengthen its technology risk management systems and controls.”

Gupta took over as CEO of the DBS Group in 2009, following 27 years at Citigroup, where he served as CEO for Southeast Asia, Australia and New Zealand.

Under Gupta, DBS expanded its operations in India, Taiwan and mainland China. Operations in Singapore accounted for about two-thirds of DBS’ income in 2023.

DBS’s CEO predicted that the bank would likely sustain its performance in 2024, despite softening interest rates and persistent geopolitical tensions. On Wednesday, the bank announced a one-time bonus for junior- and lower-income employees to help with higher costs of living.

Shares of DBS rose as high as 2.8%. The bank is the first of Singapore’s major banks to report its earnings; United Overseas Bank Ltd. and Oversea-Chinese Banking Corp will follow later this month.