“Refinement” has emerged as a leading theme for the buy side for 2024. Standardising data means saving time, cutting costs and delivering more accurate results. But how can managers continue refining their operating model while AI still emerges from its infancy?

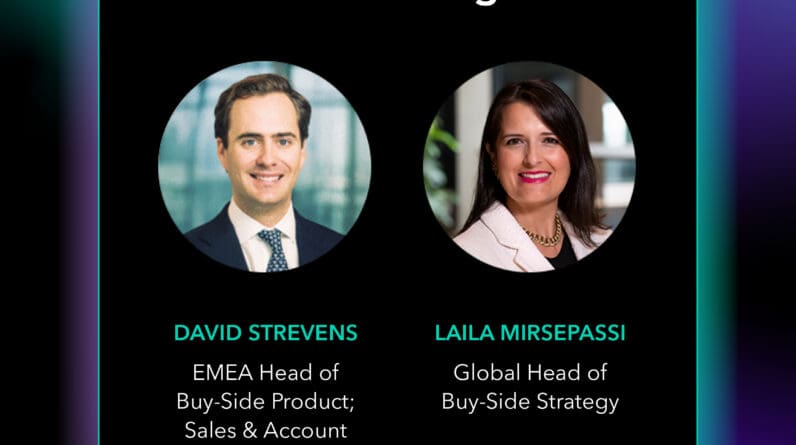

David Strevens, Bloomberg’s EMEA Head of Buy-Side Product; Sales & Account Management and Laila Mirsepassi, Bloomberg’s Global Head of Buy-Side Strategy share what they see in the year ahead: from the pressure to generate alpha to changing expectations around reporting frequency and granularity.

As we look ahead, what are some of the challenges buy-side firms are grappling with?

There are broad themes around the continued rise of alternative assets, the growing importance of ESG, and the shift from active to passive management. But when looking at these trends through the lens of what we do as a technology provider, there are four significant themes to highlight.

First is the increasing demand for openness and transparency around data, which means that firms are on a journey to standardize that data. Second is an increased pressure to generate alpha – so although a manager’s research team is their unique source, they still rely on high-quality data and well-governed research processes. Third, asset managers are burdened with more reporting demands, ranging from regulatory obligations to the end client wanting insights in a more granular or timely manner. And fourth is margin pressure, making it essential firms are efficient in their processes.

What’s driving the increased demand for openness around data?

Data is an essential commodity for firms, making the journey to better, standardized data – including market, trade and position data – imperative.

It sounds simple, but it’s amazing how often a firm, or even people on the same team, might juggle multiple systems powered by different data sets. Inevitably, team members end up with different answers to the same question. This becomes an even bigger problem when the risk manager and the portfolio manager use different data sets and models – and, unfortunately, these are the most common areas we see siloed.

With standardized, up-to-date data sources and consistent reporting formats, managers can easily get an accurate and holistic view of their portfolios across toolsets. That’s why Bloomberg is focused on enabling a firm to take a set of positions or transactions and have them face multiple engines from Market Risk, Investment Risk (Factor Models), Liquidity Risk, Credit Risk, and Counterparty Risk.

From an operating and cost perspective, this shift is critical, as it enables firms to accurately, efficiently and consistently reconcile across platforms and decommission legacy or redundant providers and systems.

How does data support the search for alpha?

As an active manager, research is essentially the secret sauce of what you do. Data underpins every step of the investment workflow; so it is foundational to the search for alpha. Every point of decision-making, from building internal research to balancing a portfolio to managing risk, relies on high-quality, consistent master data. It’s imperative that the underlying master data, as well as the analytical libraries that compute it, are accessible via APIs. Bloomberg offers a number of solutions that can help managers in their search for alpha.

Bloomberg’s Research Management Solutions (RMS) are designed to integrate seamlessly with the Bloomberg Buy-Side offering, across all asset classes. Although our RMS can be used as a high-quality standalone repository of internal research, your firm’s efficiency is increased exponentially when that research is available across your firm and combined with external research and broader security information.

Second, is Bloomberg’s BQuant, which offers a sandbox-type environment to give firms access to vast data and analytical libraries that help them derive the outputs to make intelligent decisions, whether they’re bottom-up or top-down investors.

For example, you might have a unique view of company fundamentals and need to document and share that content. BQuant has solutions to help facilitate that research workflow so that you can share and curate content throughout your organization – mixing internal and external content. This enables consistency across the organization and eliminates manager or analyst redundancies that occur when people are working on 30 different spreadsheets.

Another tool is the PORT Optimizer, which is part of Bloomberg’s portfolio analytics and risk system. It supports multi-objective optimization, helping buy-side managers achieve multiple investment goals simultaneously, and plugs directly into workflows to integrate with other systems and processes.

Finally, with all the recent uncertainty, there’s a renewed emphasis on the need to accurately quantify and understand portfolio risk. Bloomberg’s new MAC3 Risk Models include advanced techniques to produce accurate forecasts that are useful for both risk management and portfolio construction – including optimization.

It’s not just firms looking for more open access to data; investors now demand more data as well. What’s driving this demand and what are buy-side firms doing about it?

In our data-hungry world, managers experience an uptick in scrutiny from institutional investors, who expect a greater frequency – and detail – in reporting.

An added layer to consider is pressure from a regulatory perspective, for example, with EMIR Refit coming this year. Europe has long been a leader in regulatory change, which continues to evolve, particularly regarding areas such as ESG. That’s where firms want greater oversight.

In this environment, greater transparency and granularity in reporting to investors and regulators become intertwined.

There’s been so much attention on artificial intelligence, especially generative AI, and how it could affect industries, including asset management. What, if anything, are you seeing firms do to prepare?

AI has been a topic of interest for investment firms and one of the areas we are asked most about by investment executives. The desire to participate in this transformational technology is clear, though there is a range in terms of the steps investment managers are taking to prepare. This includes evaluating business use cases for the implementation of AI to streamline existing processes and considering what governance protocols are needed to provide appropriate oversight for their organizations.

In addition, investors are looking for their technology partners to help them take advantage of AI through native workflow improvements. For example, at the start of the year, Bloomberg released a tool that creates AI-generated summaries of earnings transcripts. We’ve always been a leader in helping firms generate a perspective by bringing together different data sources – earnings transcripts, broker research and news. But this AI tool means our users aren’t combing through lengthy transcripts and can quickly drill into the specific content they need.

There’s a significant emphasis on the importance of data, but this comes at a time when firms are under cost pressure. How do you see firms balance these competing demands?

Active managers are under pressure concerning their margins because the industry has become increasingly competitive. Two-thirds of asset flows are now into passive products, which is a huge shift to overall income. Plus, firms want to ensure they have accurate reporting, which comes with a cost – as does the increased emphasis on centralized data.

We continue to see many active asset managers focus on returning to the core focus of pure money management, with non-core functions being outsourced or replaced by technology, especially automation.

Bloomberg is increasingly helping firms simplify middle office processes, offering real-time processing and oversight capabilities for core workflows, underpinned by connectivity to custody, administrative and accounting providers. In doing so, investment managers are not only driving efficiency and scale but also reducing risk and lowering operational costs associated with manual processing and human error.

Automating post-trade activities can help reduce operational costs and inefficiencies associated with manual processing and human error.

For example, Bloomberg’s support for T+1 Settlement is powered by our post-trade operations package, which includes Central Trade Matching Platform (CTM) for matching, SWIFT for settlement and Trade Management Flow for automation. Key Performance Indicators (KPIs) for existing clients utilizing the operations package illustrate that 97% of all trades going through our system are matched on T+0 and 70% of all trades are sent to settlement on T+0.

By doing that well, firms can have a greater impact on their operating costs and improve margins.

PM <GO>, our new Portfolio Manager Workspace, delivers an intelligent and interactive decision-support experience, combining industry-leading data, portfolio construction capabilities, risk analytics, liquidity insights, open order oversight and embedded compliance workflows to support the investment decision-making process. This helps our clients improve their workflow by accelerating their ability to make intelligent investment decisions quickly, minimizing the time spent on manual processes and lowering potential operational risk.

Efficiency is paramount as buyside firms face increasing pressure to standardize data, generate alpha, comply with escalating reporting demands and margin pressure. By refining processes and operating models, buy-side firms are able to reduce costs while delivering accurate results and stay ahead of the competition.