This analysis is by Bloomberg Intelligence Senior Industry Analysts Alison Williams and Neil Sipes, with contributing analysis by Ravi Chelluri. It appeared first on the Bloomberg Terminal.

Banks’ debt-underwriting activity looks robust in early 2024, and US equity issuance should help fuel fees vs. a year ago. Better growth in relatively more profitable high-yield debt and European and US IPOs are poised to aid revenue for the largest competitors.

Investment-bank fees look better in 1Q

Global investment-banking fee revenue is anticipated to be better in 1Q than the year-ago period and 4Q23. Underwriting — US equities in particular — may lead fee growth, aided by markets. Corporate financing needs are further fueling debt fees. M&A announced volume is in a general uptrend since 1Q23, though regulatory and geopolitical risks remain and announcements take time to feed into fees given the typical lag in closings. Regionally, the US shows relative strength, while IPOs are a European highlight. Japan and Asia (excluding Japan) appear lower. Debt capital markets look broadly solid across regions, with Asia again an exception.

Solutions for banks and broker dealers

Global investment-banking fee revenue is anticipated to be better in 1Q than the year-ago period and 4Q23. Underwriting — US equities in particular — may lead fee growth, aided by markets. Corporate financing needs are further fueling debt fees. M&A announced volume is in a general uptrend since 1Q23, though regulatory and geopolitical risks remain and announcements take time to feed into fees given the typical lag in closings. Regionally, the US shows relative strength, while IPOs are a European highlight. Japan and Asia (excluding Japan) appear lower. Debt capital markets look broadly solid across regions, with Asia again an exception.

Global bank equity fees could broadly rise in 1Q

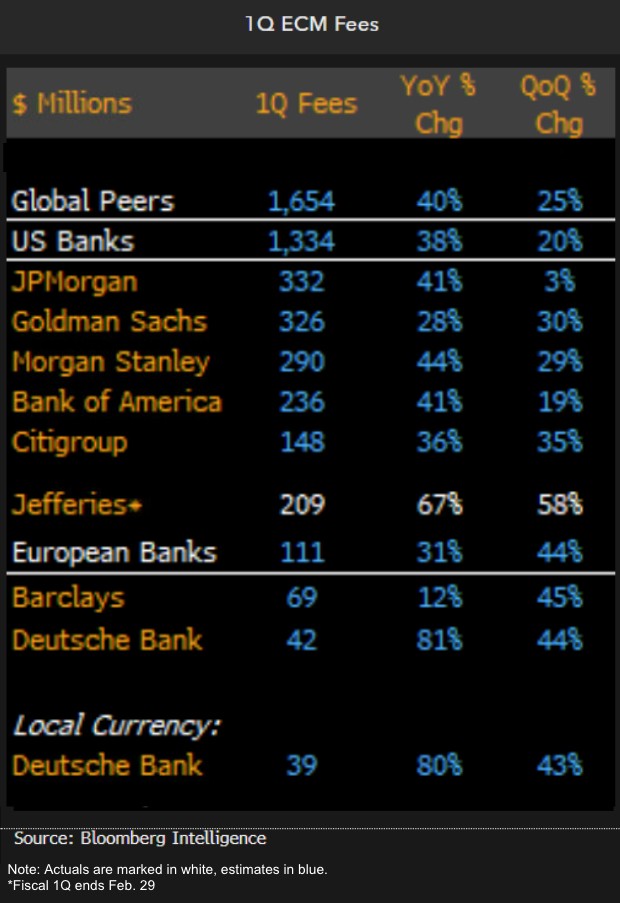

Jefferies 67% equities-fee jump in 1Q is a positive indicator for peers, along with strength in underwriting volume. Bigger US banks may see fees jump compared with a softer year-ago quarter and a seasonally weaker 4Q.

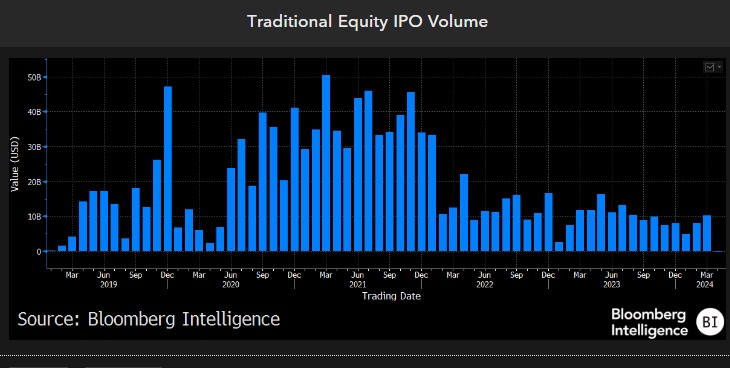

Steadier IPOs a good sign, with room to run

Traditional IPO activity increased a modest 2% from 4Q, though volume was down about 10% compared with the year-ago period. We see this as a sign of further steadying, with underlying activity for the US and Europe positive at the margin for domestic competitors. There’s a long runway for more improvement, as volume remains well below historical averages.

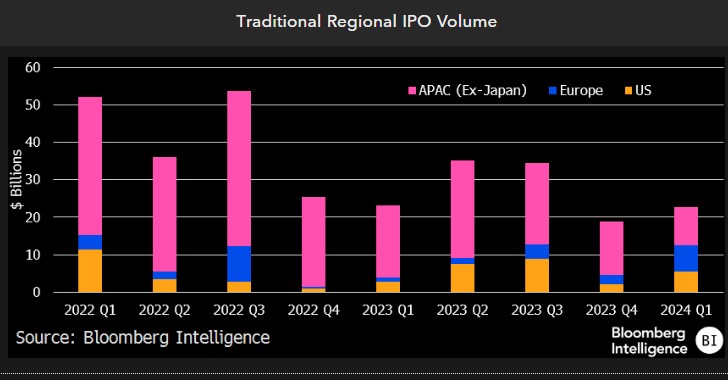

US IPO activity more than doubles, Europe multiplies

US and European IPO activity jumped from a weak year-ago, while Asia moderated — both Japan and other regions – driving overall volume lower.

Global Equity Issues Boosted by Stronger US Volume

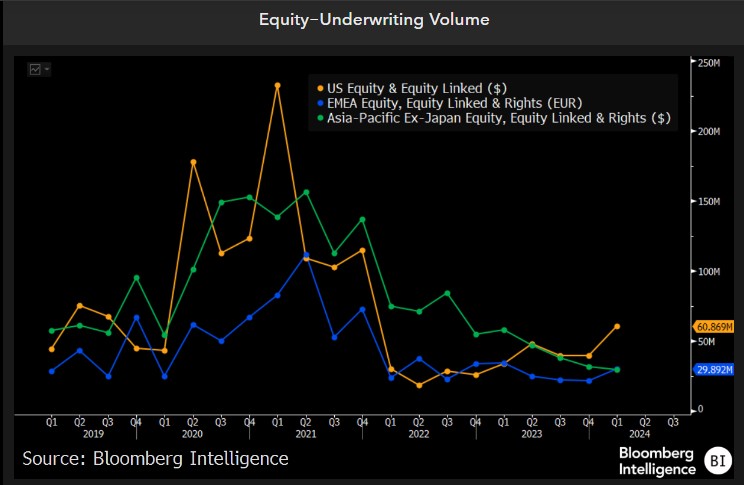

Global equity issuance, including equity-linked and rights, rose 6% in 1Q from year-ago levels, helped by US volume about doubling. By contrast, Asia-Pacific (excluding Japan) volume declined 47% and Europe, the Middle East and Africa was down 13%. Sequentially, volume was about 23% above 4Q.

Goldman Sachs, Bank of America, JPMorgan, Morgan Stanley and Citigroup were the top global equity underwriters in 2023. Fees are more meaningful to Goldman and Morgan Stanley, though less than Jefferies’ skew.