This analysis is by Bloomberg Intelligence Senior Analyst Philip Richards and Associate Analyst Uzair Kundi. It appeared first on the Bloomberg Terminal.

South African banks’ two years of consensus EPS upgrades could reverse as political uncertainty around the upcoming presidential election compounds weak economic conditions. A margin squeeze on imminent interest-rate cuts, electricity blackouts and high unemployment drain confidence, limit loan demand and raise impairments.

Bloomberg Intelligence: Data-driven research

EPS estimates falling on rates, charges

Rising policy rates and falling impairments — aided by the release of provisions built up during the pandemic — powered net EPS estimate upgrades for South Africa’s leading banks over 2021-22, but have since stalled and are now beginning to reverse. Market-implied rates suggest no further interest-rate hikes from a current 8.25%, with cuts possible within three months. We also expect cost of risk to move higher from below-normalized levels for most lenders, while economic conditions are deteriorating. Combined, those could drive a reversion to net downgrades.

Our basket comprises the leading six South African banks, assessing whether EPS estimates were raised or lowered each month, based on 12-month forward consensus. The net balance each month ranges from six (all upgrades) to minus six (all downgrades).

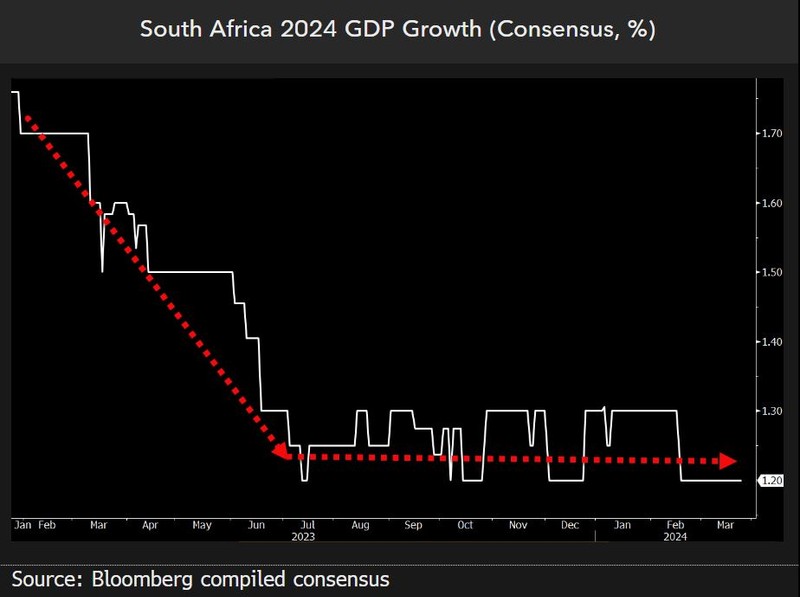

Stalled growth weighs on lending prospects

A key drag on local banks, including FirstRand and Standard Bank, from the electricity crisis in South Africa is a collapse in business confidence and a contraction in economic growth. Economists have slashed 2024 economic growth estimates to just 1.2%, down from an already weak 1.7% expected at the start of last year. Combined with inflation of about 6%, that implies nominal GDP growth of 7% per annum. While banks may be able to tread water with lending growth at about that level, political uncertainty into the Presidential elections are likely to weigh, meaning banks are unlikely to deliver higher lending growth than that.

Longer-term opportunity exists for local lenders as corporates and households invest in renewable energy sources, but coal-based electricity generation is likely to remain the primary source near-term.

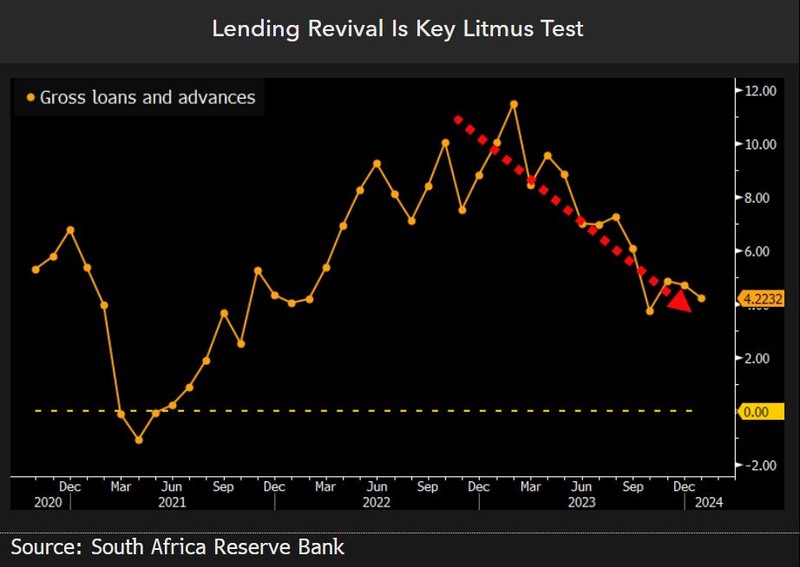

Lending growth to remain subdued

South Africa lending growth had weakened in the face of a challenging and deteriorating economic environment, weighing on local banks’ revenue outlook, slowing to just 4% recently from above 10% in early 2023. A weak housing market, political uncertainty ahead of the Presidential elections, low corporate confidence and elevated unemployment could combine to keep lending growth within a subdued 4-6% range through 2024, which would imply zero or negative growth in real terms compared with an inflation rate of about 6%.

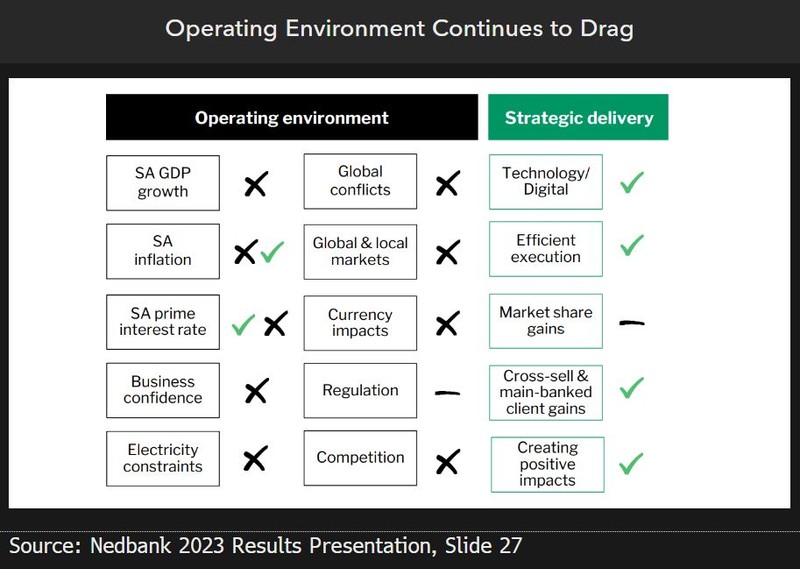

Challenging operating environment to remain

The outlook for South Africa’s leading banks remains challenging, with little prospects of that improving any time soon. GDP is expected (based on Bloomberg-compiled consensus) to grow just 1.2% this year, inflation is moderate at 5-6% and business confidence levels are low, dragged by worsening (by occurrence and severity) electricity blackouts. Rand weakness weighs on the contribution from overseas earnings and local competition, from players including Tyme Financial, Discovery and the revitalized African Bank, is rising.

Elevated interest rates remain the one bright spot for lenders, though no more hikes are likely, with cuts to follow within months, based on market implied rates.

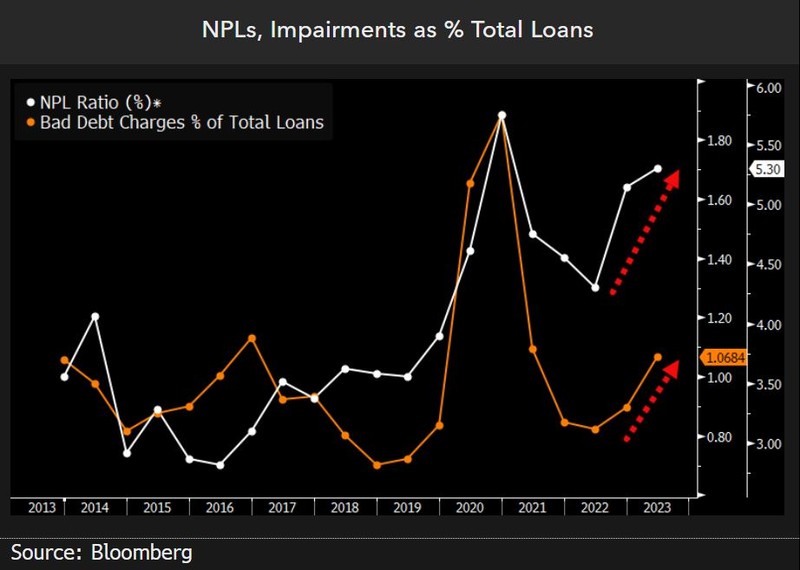

Credit charges moving higher

A cautious approach to new lending and rigorous credit standards ensure that bad-debt charges at South African banks were able to recover quickly from pandemic-induced highs, but they are at risk of moving higher again this year. Charge-off rates above 100 bps are already back above both the 2014-19 average and banks’ normalized levels. Sharply higher interest rates, along with a fragile economy, threaten to push those higher again, though we expect charges to remain manageable. Drag from a weak economy is more likely to be felt on revenue growth than a sudden deterioration in credit quality.

South Africa’s small mortgage market means higher-risk unsecured personal lending and motor-vehicle finance make up a larger share of bank loan books than is typical elsewhere, driving higher charge-off rates and non-performing loans.