Investors seeking greater portfolio diversification, as well as the prospect of higher returns in a treasury-like market, should consider mortgage-backed securities (MBS). As an investment vehicle, MBS typically offer higher yields than government bonds.

Explore our index families.

Current MBS Environment

During 2020 and 2021, a substantial number of U.S. homeowners refinanced their mortgages, taking advantage of record-low interest rates. As a result, low coupon MBS dominated the MBS Index. As of December 2023, MBS with coupon ≤ 3% accounted for approximately 65% of the index, while the 30-year current coupon is at 5.3%.

Prepayments in the MBS market are near historic lows, closely correlating with the degree of refinancing incentive. The low prepayment activity for lower coupon securities results in higher duration, lower option-adjusted spread, and positive convexity for these securities compared to typical MBS securities (See Figure 1). These securities and the index exhibits strongest correlation to Treasury markets seen in the last 25 years, implying the index has very similar characteristics to Treasury given the low prepayment rates, while providing a potential of earning additional spread on top.

Key advantages of investment in MBS include:

Agency MBS are unique in that they are either explicitly or implicitly guaranteed by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, thus providing investors a shield from homeowners’ default risk, while also providing historically higher yields than Treasury bonds with similar duration.

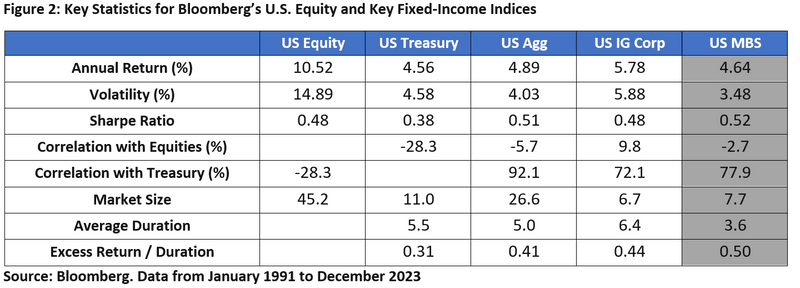

Historically, the Bloomberg MBS Index (LMUSTRUU) has performed with a higher Sharpe ratio than other major fixed-income benchmarks, even in predominantly bullish interest rate markets. It also offers diversification benefits to both equity and treasury portfolios.

Agency-backed MBS make up a large component of the U.S. Bond market, accounting for about 27% of the Bloomberg U.S. Aggregate Index as of December 2023 and representing a significant portion of broad fixed-income portfolios.

Bloomberg Agency MBS Index Construction

The Bloomberg U.S. MBS Index (LUMSTRUU) is a widely recognized benchmark for MBS markets that tracks fixed-rate agency, mortgage-backed, pass-through securities guaranteed by government-sponsored entities like Ginnie Mae, Fannie Mae and Freddie Mac. The composition of the MBS index focuses on fixed-rate pool aggregates with at least $1 billion outstanding and a weighted average maturity of at least one year. The aggregates are formed by grouping individual fixed-rate MBS pools together based on specific criteria like program, coupon, vintage and specified cohort.

Differentiating Characteristics of Agency MBS Securities

Agency MBS securities are exposed to different risks relative to U.S. Treasuries or corporate bonds. Two main considerations include prepayment and extension risks. MBS exhibit negative convexity because of the potential for homeowners to refinance their mortgages in response to declining interest rates. This results in early principal repayments and shorter duration of the MBS. To compensate for this prepayment risk, buyers of MBS demand a premium (MBS spread) over Treasury securities.

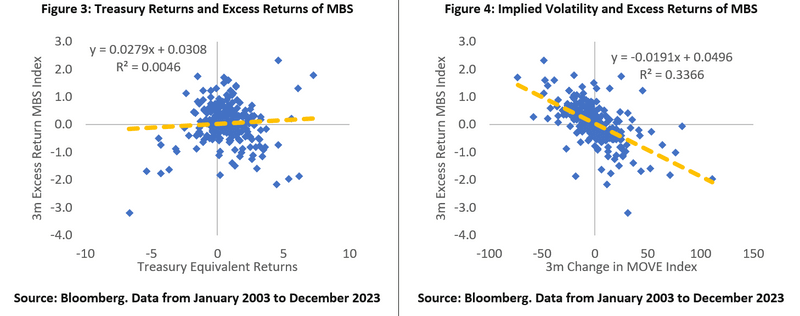

The excess returns of the MBS Index mainly reflect the short-call option exposure of MBS investors. The Merrill Lynch Option Volatility Estimate (MOVE) index serves as a reliable measure of broad U.S. bond market volatility, effectively proxying for this variability. The correlation between Treasury returns and MBS excess returns is merely 7%, while the correlation between the MOVE index and MBS excess returns stands at -58%, indicating a notably strong negative relationship.

Considerations for Investing in MBS

MBS market access can be a challenge, as the management of MBS pools is operationally complex for some investors due to monthly principal payments, not to mention the challenges of sourcing specified pools. As a result, some investors opt for establishing portfolios using To-Be-Announced (TBA) contracts. In fact, the vast majority of agency MBS trading occurs in the TBA market, where participants agree on a future delivery date for a notional amount of MBS even though the specific securities are not designated. The seller, who controls the delivery, may opt for the cheapest-to-deliver securities. Hence, TBA securities typically trade at a discount to the specified pools and often present lower carry opportunities.

Agency MBS ETFs offer an alternative option for accessing MBS markets, as they generally offer better liquidity than the specified pools and are usually simpler to manage for investors. ETFs also offer a diversified portfolio of individual CUSIPS as a single line item in the client portfolio, which may provide investors exposure to the market more quickly.

Conclusion

Mortgage-Backed Securities (MBS) present an investment option for investors seeking diversification and competitive yields in their portfolios. Historically, the MBS Index has demonstrated a favourable Sharpe ratio and outperformed other major fixed income benchmarks such as US Treasuries. It has offered diversification benefits to both equity and Treasury portfolios as shown by low correlations in Figure 2.

The Bloomberg US MBS Index has established itself as a reliable benchmark for the MBS market. Its recent transformation in 2022, incorporating specified pools into its pricing structure, has enhanced transparency and better captured specific pay-up narratives. The three largest US MBS market ETFs track the Bloomberg MBS indices. These ETFs can provide convenient access to the broad market with reduced operational burden relative to managing and trading mortgages. Like other Fixed Income ETFs, MBS ETFs generally provide improved liquidity and transparency compared to individual securities. While individual MBS prices are often traded OTC, ETFs trade on exchanges, similar to stocks, facilitating price discovery.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.