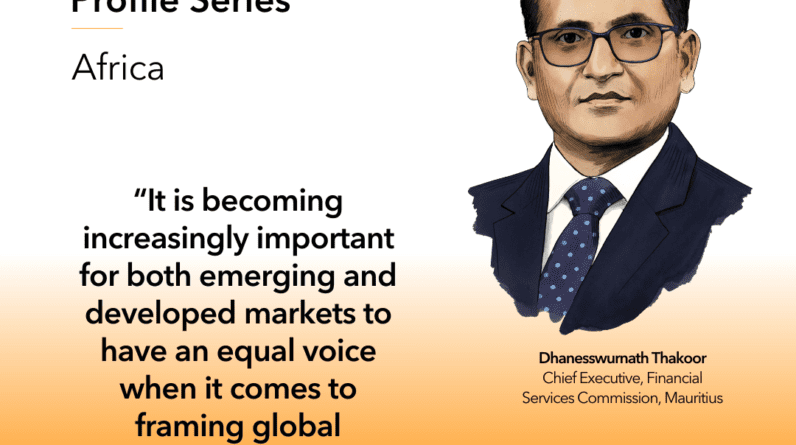

Dhanesswurnath Thakoor shares his perspectives on the green agenda, his advice to the younger generation, and how regulators can remain effective and coherent in implementing global standards.

How did you get to where you are?

I had a very non-conventional pathway to the world of finance. Graduated initially as an electronic and information technology engineer, I started working at the Central Bank in the IT department, where I had a lot of interactions with the world of finance. This inspired me to take on a Master of Business Administration in finance. And at some point, I switched to the business side looking after the systems that actually provide the banking services. I worked extensively in the field of payment systems. After 26 years at the Central Bank coming to the Financial Services Commission was a natural pathway given that I have been working in a financial regulatory institution.

How do you unwind?

I generally give lots of importance to sports and sports related leisure activities. I make it a point that in the busy schedule I visit the gym at least every day for an hour. And I have also recently taken up some yoga and meditation activities as another way to flush out the daily stress of the work.

What inspires you?

Actually, everything inspires me from the emerging new technologies to the world of finance, but also these days very much into the climate area, as well as the world of physics and spirituality. I believe that all converge to give the person a complete knowledge about what we are and need to do.

What is your advice to the younger generation?

General reading in any subject. Learning to understand and not necessarily learning to go through an examination should be the way we must take on subjects. There is no such thing as defined pathways to the summit of a career. One needs to just take life as a lifelong learning experience. But, whenever one is called upon to do something, the person must give his best shot and the rest will follow because at some point in time, it is the quality of the output that will drive the success of the person.

Describe the role and importance of a regulator in ensuring fair and transparent financial markets.

Ensuring fair and transparent financial markets is a key mandate for a regulator like FSC Mauritius which also has a duty to protect investors. FSC Mauritius is a member of various international organisations and subscribes to international best practices. For example, FSC Mauritius is a member of IOSCO and follows IOSCO’s Core Principles and is also a signatory to IOSCO MMOU for an effective exchange of information with our international counterparts.

Through its rule making process, publications of Guidelines and Circulars, the FSC Mauritius ensures that every player in the market is treated on a level playing field. There is often a process of consultation with the public and other stakeholders before rules and major legislations are finalised.

The regulator has also a duty to educate consumers of the risks associated with investing into certain financial products. Licensees should also understand their obligations under the law and the consequences of potential breaches. An agile regulator can thus bring more confidence to the market and investors as well by working continuously towards fairer and more transparent financial markets.

The fight against financial crimes is closely linked with the critical role of the regulator in ensuring a fair and transparent financial market. Recognizing the need for increased efforts to implement AML/CFT/CPF standards, the FSC, has deployed significant financial and human resources, to create a conducive ecosystem to detect and fight financial crimes. These actions are in line with our core mandate to achieve sustainable development and prevent financial exclusion. The adoption of a robust risk-based approach to supervision with the development of an AML/CFT Risk Based Supervision framework is key to respond to the evolving AML/CFT threats and vulnerabilities for the regulated financial institutions.

In an ideal world, how would you shape global standards to ensure frontier, emerging, and developed markets have an equal voice?

It is becoming increasingly important for both emerging and developed markets to have an equal voice when it comes to framing global regulatory standards. Certain international standard setting bodies like IOSCO have already understood the contribution that emerging markets can provide to, for instance, drafting up of new principles which can be applied globally.

Regional bodies/ Committees like AMERC, the IOSCO’s Growth and Emerging Markets Committee are channels whereby regulators from developing countries can take stock of the latest developments and engage in fruitful discussions. It is very important that emerging countries have a say in any transnational law-making process, through engagement in forums/ meetings/ and participation in survey questionnaires, for instance. Transfer of expertise/ capacity building programs can also help in reducing the gap between emerging and developed markets, especially on topical issues like fintech/blockchain technology and sustainable finance.

Moreover, Regulators throughout the world have been adopting and implementing internationally recognized standards to be able to operate in a globally competitive market environment over several decades. However, the current system of standards should be reviewed to have an inclusive approach and adapted to the local jurisdictional context for an effective, coherent application in a development-oriented manner. The focus should be on generating priorities based on informed risks and producing results. There is urgent need to shift from purely technical compliance with international standards to effective implementation whilst at the same time avoiding unintended consequences.

What are the key emerging regulatory trends and how are you as an organization addressing these new risks to remain effective?

Climate change & Green/ Sustainable Finance is definitely a topic high on agenda across regulators worldwide. Mauritius has taken international commitments to adhere to the UN Sustainable Development Goals and FSC Mauritius endeavours to be a key stakeholder to facilitate the greening of the economy and reduction of carbon footprint. FSC Mauritius has already issued the Guidelines for Issue of Corporate and Green Bonds in Mauritius (Dec 2021). Those Guidelines have been benchmarked as per international norms and standards and aim to encourage a new ecosystem for green issuers. Furthermore, FSC Mauritius has recently joined the Network for Greening the Financial System as a plenary member.

Virtual Assets and the need to have intelligence-sharing between private-sector entities are also considered amongst the key emerging regulatory trends. Data and technology remain a key component to transform the fight against financial crimes with tangible result and impact on emerging ML/TF and PF risks. Additionally, fostering exchanges with the private sector focusing on developing concrete solutions and actions help in the promotion of a culture of compliance and inclusiveness for sustainable development.

What does the future of financial services in Africa look like?

Africa has a lot in terms of untapped resources. The region is already endowed with mineral resources (e,g gold/ diamonds/ agricultural products e,g cocoa/timber etc.). There are opportunities to develop further commodity/ commodity derivatives exchanges in the region. This may in turn foster the creation of a proper ecosystem including brokers/ advisers/ clearing & settlement houses/ credit rating agencies etc. The Bourse Regionale des Valeurs Mobilieres (BRVM) in the West African region, the Cairo Stock Exchange, the Nairobi Stock Exchange and the Johannesburg Stock Exchange are already amongst the best performing exchanges in Africa.

There are initiatives to connect various stock exchanges to allow African investors to have access to new markets and for investors to have access to cross border capital. In the medium to long term investments will be more fluid across the African continent.

On the regulatory front, organizations like CISNA (which regroups SADC non-bank regulators) have the mandate to harmonize laws so as to facilitate the flow of investments regionally. Finally there are also enabling organizations in Africa like the African Union, COMESA, SADC and ESSAMLG which cater, amongst others, for enhanced integration whilst setting standards to fight against money laundering.

This profile forms part of Bloomberg’s Regulatory Affairs insights series and is independent of Bloomberg News.