Commodities are unique, with their drivers of performance differing from the more traditional asset classes. Macro tailwinds helped propel equities and fixed income to very robust valuations over the last decade, while commodities were hit with headwinds in the 2010s. Recently, the tables have turned leading to a supportive environment for commodities. Commodities prices give a live look at the world economy as they are traded via spot prices reflecting supply and demand today. They can tell a story of how consumers, companies, and governments transact on the most important raw and processed materials. The prices of commodities are inputs to inflation readings, which have cooled over the last year, but current signs and historical precedent indicate we may not have completely sailed smoothly back to a low inflation landing. In this blog, we discuss why commodities are important today, how commodities have reacted in prior inflationary scenarios, and the current market sentiment across the broader commodities landscape.

Explore our index families.

Economic significance

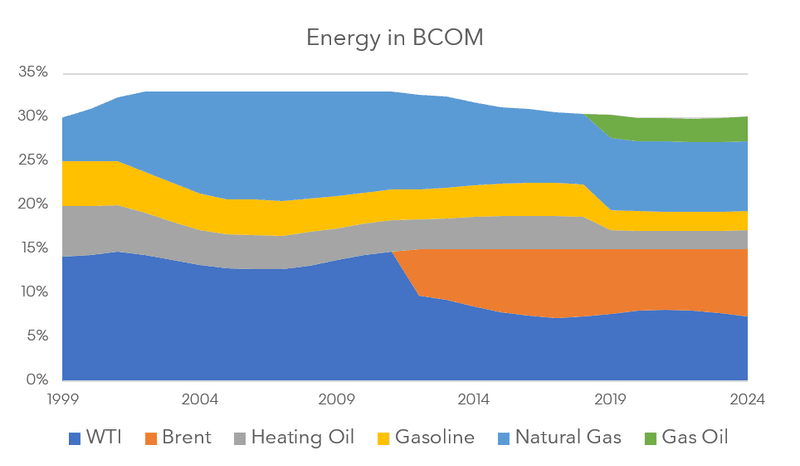

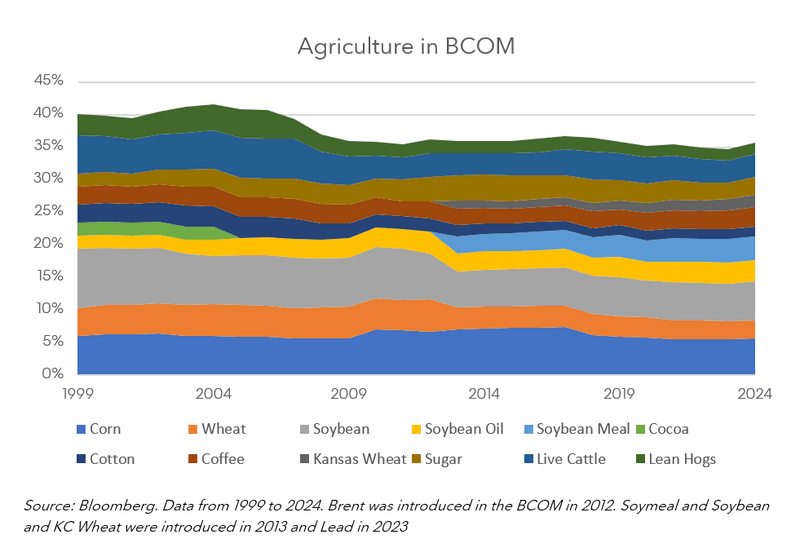

Market participants may be looking to real assets to diversify their allocations as equity markets have made new highs and valuations are stretched. Commodities are looked to because they are real assets that are the building blocks of the world economy forming the base for all goods and services today. Some are more supplied than others, but all can be considered scare resources even though the level of scarcity can vary widely. This scarcity of supply can be reflected in the price of an ounce of Gold versus the price of a bushel of Wheat. Demand is the second part of the equation effecting commodities prices and this changes over time as newer technologies take hold and displace previous outdated ones that use different materials. A global benchmark index that illustrates and expresses the changes in market significance is the Bloomberg Commodity Index (BCOM). Let’s use BCOM as a proxy to explain how these relationships have changed over time. The 6 major sectors of BCOM have stayed mostly the same over the past 25 years but under the hood, individual commodities’ importance shifted (Exhibit 1). Within BCOM, the weights of metals have increased as production and trading volumes of the underlying futures contracts have increased over time. Part of the reason for this increase was the massive expansion of China’s industrial complex over the last few decades and most recently the energy transition shift to the industrial metals that make up renewable and electrification technologies. In its construction, the BCOM allocates a third significance to world production data and two-thirds significance to liquidity to generate target weights per commodity.

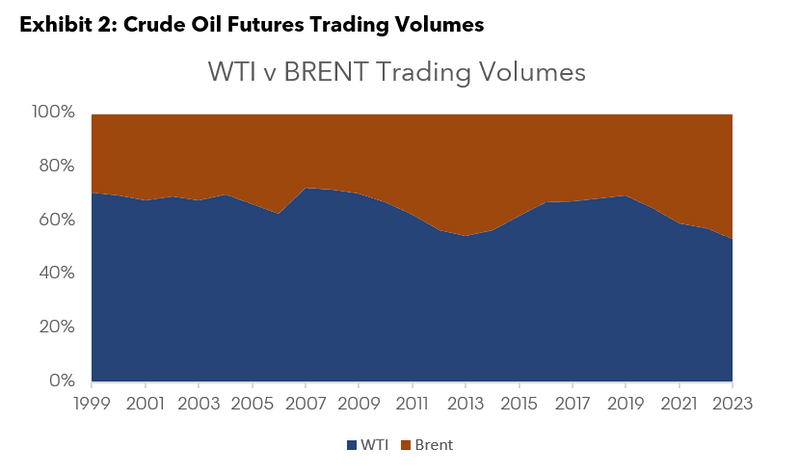

Within Energy, West Texas Intermediate (WTI) Crude Oil was historically the biggest weight among the constituents. The introduction of the Brent Crude Oil contract to the index coincided with the increase in trading in the underlying futures market. The trading volume in both oil futures contracts increased over time but WTI trading volumes have only risen by 3.5x while Brent volumes rose 8.5x higher than they were in 1999. The recent shift could be attributed to the rise in prominence of Brent after WTI prices dipped into negative territory in April of 2020. (Exhibit 2). In the calculation of the BCOM target weights for WTI and Brent world production data inputs are the same, however the liquidity components differs and that is reflected in the target weight; i.e. as Brent liquidity has risen so has its representation of weights in the BCOM.

Agriculture weights within BCOM have fallen over time with the relative weightings amongst the constituents staying relatively consistent. The main reason total BCOM Agriculture commodity weights fell was due to the much bigger increase in trading and production of the metals markets squeezing out the much more established Agriculture with their longer history. In the much longer history of commodities going back hundreds of years, metals are a relatively newer component in terms of how economically significant they are today. Metals, on a longer historically lookback, have only within the last few decades gained significant ground in comparison to Agriculture which has been the most prominent commodity sector in human history.

BCOM is constructed and maintained in a way to ensure it represents the most economically significant material in the world today. This allows market participants to use BCOM as a way to track the progress of the world economy as it changes and certain materials become more economically significant than others.

Inflation: A repeat of 1970s?

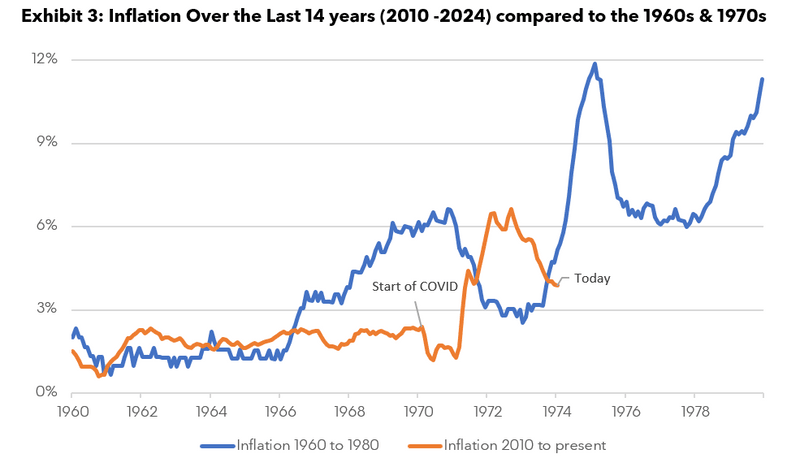

The market seems to have subscribed to the soft-landing narrative: no recession and inflation under control. We can see this playing out in investors positioning their portfolios to have low exposure to the sectors and assets best placed to weather inflation. One of those asset classes is commodities. Allocations to commodities are currently near historic lows. In the short term, the slowdown of China and easing geopolitical tensions coupled with well supplied commodities also play a factor. Looking back historically to the 1960s and 1970s in the US, we saw an initial ramp up in inflation after a decade of inflation that was even lower than the 2010s. If we use this period from over 50 years ago as a playbook, another unexpected rise in inflation may be in store over the next few years. Rarely is inflation solved by Federal Reserve policy and the potential for another uptick in inflation is increasing every day. Economic growth and high employment are still expanding GDP and providing the backdrop for increase in prices. Commodities tends to be an effective hedge during periods of unexpected inflation.

Over the past few months, we have seen very subdued volatility in commodities. One-day percentage moves have been much lower than over the past few years. Similar to the low volatility seen in equities as represented by the VIX, these low volatility environments present an appropriate period to consider exposure relatively to a highly volatile environment which is historically associated with material price moves.

Muted market sentiment

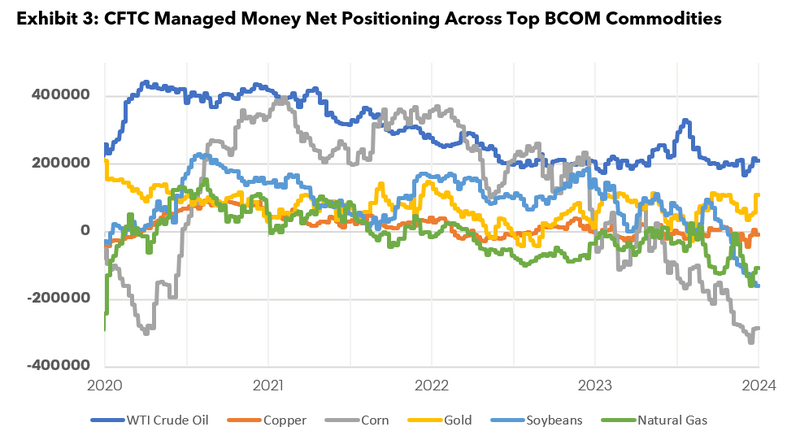

Long positioning in commodities is at historical lows in the first quarter of 2024. Short positions in grains and natural gas pushed several commodities prices lower. When leveraged fund positioning is near historical extremes, this tends to be a leading indicator for an inflection point in the price of the futures contract. When looking at publicly available commodity ETF assets under management, one can see positioning in commodities has come down. The latest commitment of traders reports from the Commodity Futures Trading Commission (CFTC) show positioning across most major commodities is either via small or quite short near extreme levels. In Exhibit 3, short positioning in Corn, Soybean, and Natural Gas are at levels last seen during the depths of the COVID-19 Recession while Crude Oil, Copper, and Gold have some of the smallest net long positioning seen over the last few years. Clearly, market participants are nowhere near as positioned in commodities as they are in equities and fixed income.

For some commodities, like the major Grains and Natural Gas, which are all down double-digit percentage points to start the first two months of 2024, it’s important to look at seasonality and what could be the catalyst for a change in price movement. Market floors can be created as short covering risk grows and Commodity Trading Advisors (CTAs) and others drastically reduce massive short positions they have built. To be fair, prices and sentiment in the Grains and Natural Gas may be justified due to large supply above five-year averages at this time of year across these groups. A similar case could be made for most of the major Metals and across Energy as there is plenty of spare capacity across the oil majors.

One area that has experienced explosive price appreciation recently is the Softs sector consisting of commodities like Coffee, Cotton, and Cocoa. An interesting dynamic is in place for these commodities as adverse weather events have severely hampered crop production. Cocoa prices are hitting record highs this year and are on pace for the best quarterly performance in over 30 years.

Commodities allocation in a portfolio

To conclude, commodities are an asset class representing economically significant materials powering the engine of the world economy. Exposure to commodities provides exposure to the supply chain of every business across industries. Commodities tends to perform well during inflationary periods and while it has cooled today, if history from the 1970s is to repeat itself, a situation like we are in right now could be the calm before the storm and presents an opportunity to consider the potential benefits of commodities diversification through the BCOM family as well as Bloomberg Enhanced Roll Yield (BERY) index. Unlike equities allocations, commodities positioning is near historic lows and is not a headwind. BCOM provides exposure to a currently overlooked asset class, diversifying portfolios with a benchmark that is economically significant and can also provide an effective inflation hedge.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.