Every year, Ohio’s minimum wage rises based on inflation. With every minimum wage increase, small business owners need to make sure their payroll is up to date and compliant as well as accounting for increased labor costs in their budget.

Accidentally paying your people the wrong wage can leave your business open to costly fines and lawsuits — and you’ll risk dissatisfied staff and a bad reputation.

Our ultimate guide will tell you everything you need to know about Ohio minimum wage 2024. We’ll show you how to stay on top of minimum wage changes so you can avoid nasty surprises and feel confident you’re paying your people properly.

Understanding Ohio minimum wage for tipped and non-tipped employees

According to the Ohio Department of Commerce, the current minimum wage across Ohio for non-tipped employees is $10.45 per hour, as of January 1, 2024. That’s an $0.35 increase from 2023’s minimum wage rate. The minimum wage applies to employees of businesses with annual gross receipts of more than $385,000 per year.

This is a little different for “tipped employees” — classified as workers who regularly earn more than $30 per month in tips, like servers, bartenders, and hairdressers. The minimum hourly wage for tipped workers in Ohio is $5.25 in 2024 (up from $5.05 last year).

Though tipped employees can be paid a lower cash wage, employers need to make sure that their workers’ tips and base pay add up to an hourly average of at least $10.45 across the pay period. If not, employers are responsible for topping up their paycheck.

That means it’s extra important for small business owners in service or other tipped industries to keep track of tips as well as wages. Payroll tools like Homebase can make the process simple with tip shortage calculation functions that automatically supplement workers’ wages when they fall short on tips.

Exceptions to Ohio minimum wage 2024

All businesses with gross receipts of over $385,000 per year must pay Ohio’s minimum wage. However, SMBs who make less have an exemption under Ohio law: they can pay the current federal minimum wage of $7.25 per hour instead.

There are also exemptions for different categories of employees.

Some key exemptions include:

Employees under the age of 16

People employed as babysitters or live-in companions, if their duties are performed in the employer’s home and don’t include housekeeping

Workers within family-owned and operated businesses who are family members of the owner

People who voluntarily provide charitable services in hospitals or health institutions for free

Staff at children’s camps or recreational areas that are run by non-profit organizations

A sub-minimum wage rate may also be paid in cases where this will avoid hardship and loss of employment opportunities for those with mental or physical disabilities, but this must comply with the regulations of the Director of the Ohio Department of Commerce.

Minimum wage changes

On January 1, 2024, Ohio’s minimum wage increased to $10.45 hourly for non-tipped employees and $5.25 per hour for tipped employees, according to the Ohio Department of Commerce.

The exemption threshold for businesses will also be higher: the new minimum wage only applies to employees of companies who gross more than $385,000 per year.

The law behind this pay increase is a 2006 Constitutional Amendment in Ohio that ties the state minimum wage to the Consumer Price Index for the previous year. That means that wages rise annually based on inflation.

There are also initiatives in certain cities in Ohio encouraging employers to pay wages higher than the current minimum. For example, the City of Cleveland has partnered with One Fair Wage to offer certain businesses, like restaurants and coffee shops, a grant to pay their staff more.

Overtime pay requirements

On top of the base minimum wage, Ohio employers must pay overtime — at 1.5 times the regular hourly rate — to staff for any hours over 40 they work in a single week.

There is an exception to this for businesses with less than $150,000 in gross receipts.

As all small businesses know, overtime costs can creep up rapidly — especially if your company relies on shift work.

Let’s say your restaurant rosters staff on a 2-2-3 schedule, where some weeks, teams will work 5 12-hour shifts in a week.

That’s a total of 60 hours worked in the week (5 days x 12 hours each day).

The first 40 hours are paid at the regular rate of $10.45 per hour, totaling $418.00. But the remaining 20 hours are calculated at time-and-a-half, which amounts to $15.67 per hour in Ohio. You’ll end up paying $313.50 in overtime, and $731.50 for this 40-hour week.

To avoid mounting costs, you’ll want to either take a different approach to employee scheduling or plan for these labor costs.

As well as planned shift work, small business owners need to stay on top of unexpected overtime costs due to last-minute schedule changes or cover.

Posting & Recordkeeping Requirements

In addition to paying the legal minimum and overtime wages, Ohio employers must comply with specific posting and recordkeeping rules.

At each workplace or job site, businesses are required to display the most recent official Ohio Minimum Wage poster published by the Ohio Department of Commerce’s Division of Industrial Compliance — this changes each year with updates to the minimum wage.

Employers must also keep clear payroll records for at least three years, showing the name, address, occupation, and rate of pay for each individual employee, as well as a full record of their hours worked per day and week and how much they were paid for each pay period.

Failing to meet these documentation standards can trigger fines and investigations, so it’s crucial that small businesses choose the right system to keep track of payroll.

Tips to comply with Ohio minimum wage

Staying compliant with evolving Ohio labor laws and minimum wage rules takes effort as a small business owner. But non-compliance means risking financial penalties, lawsuits, damage to your reputation, and dissatisfied employees.

Here’s how to steer clear of violations and make minimum wage compliance a priority:

At the end of the year, note new minimum wage rates that will come into effect in January. Set calendar reminders so you don’t forget.

Download and post the latest official Ohio Minimum Wage poster before January 1 each year to clearly communicate legal rates to employees — and comply with the law.

Before minimum wage increases take effect, update your payroll systems, timekeeping tools, and accounting software. Tools like Homebase can alert you when there’s a change and automatically update your payroll based on relevant labor laws.

Review all staff classifications to make sure you’re correctly applying minimum wage rates based on factors like employee age, tipped status, and hours worked.

Maintain thorough payroll records showing hours worked, rate of pay, and overtime earnings for every employee as proof of compliance.

As well as tracking hours, track tips earned by servers, hosts, hair stylists, and other tipped employees. Ensure their tips reliably combine with lower base pay to meet or exceed the full minimum wage.

Feel confident you’re compliant with Homebase

Managing minimum wage can get complicated with so many changes at play. For small business owners who are already time-stretched, staying on top of all the different regulations can feel overwhelming.

But you don’t have to go it alone. Homebase helps small businesses like yours simplify payroll and compliance.

Here’s how:

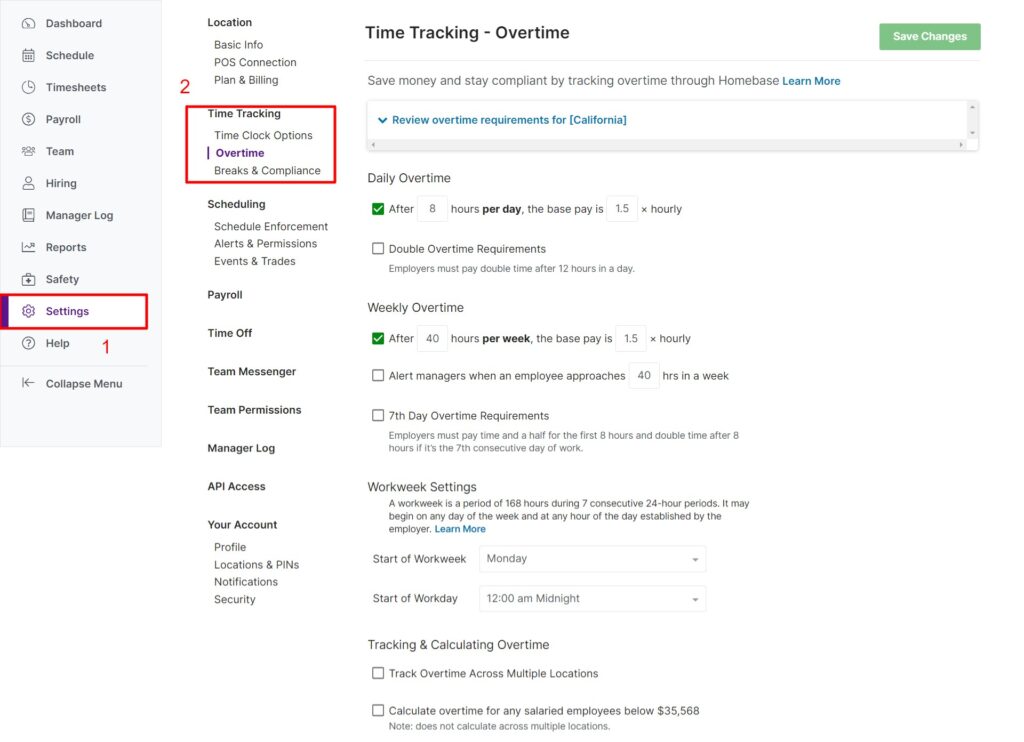

Automatic payroll calculations: Homebase calculates hours, breaks, overtime, and PTO when your employees clock in and clock out. That all gets synced with payroll to help you avoid mistakes.

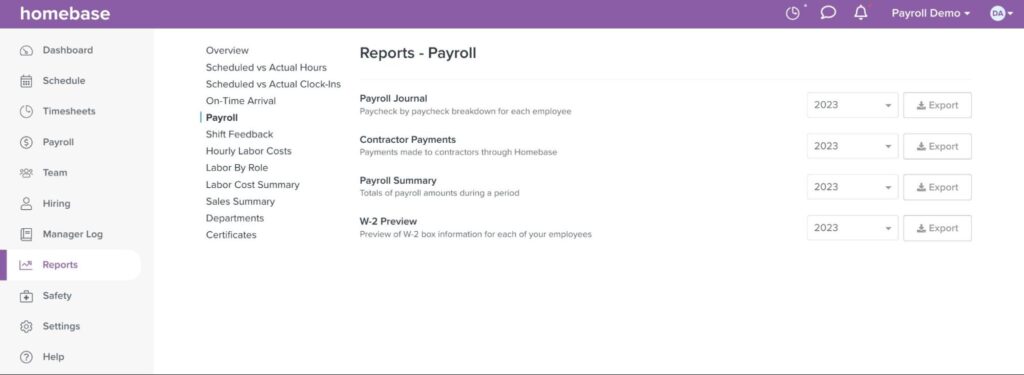

Detailed records: Homebase tracks hours worked, pay rates, and overtime details for every employee. Detailed wage statements provide protection in case of an audit or lawsuit.

Proactive compliance alerts: Homebase sends timely notifications of upcoming minimum wage and regulation changes so you always stay current — and if you have any questions, you can talk to an HR pro to straighten things out.

With Homebase as your payroll and compliance partner, you can feel sure you’re paying your people fairly and accurately.