The expected post-holiday slowdown, compounded by extreme cold weather conditions, drove business activity down for small businesses across all industries in January.

Industries that rely heavily on foot traffic, including Food & Drink (-6.7%) and Entertainment (-8.8%), endured the most severe impact of these conditions.

Noteworthy trends this month:

After closing 2023 with consistent wages, employees at small businesses saw a 1.8% monthly increase in pay rate after the holiday season.

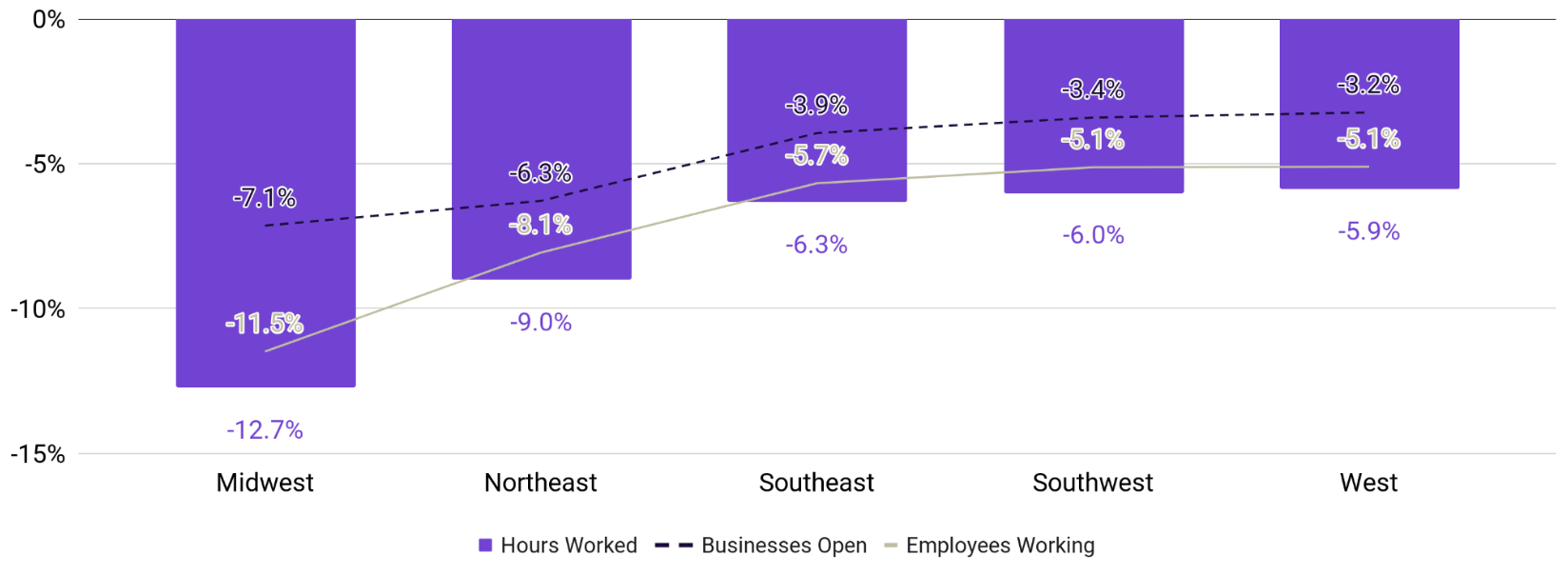

The Northeast (-9.0%) and Midwest (-12.7%) saw the biggest post-Christmas comedown in hours worked at small businesses in January, while the Southwest saw a massive drop in business activity during the deep freeze that began around MLK Day.

Small businesses experienced elevated post-holiday turnover and a higher-than-expected increase in hiring, driving elevated labor costs as seasonal workers departed.

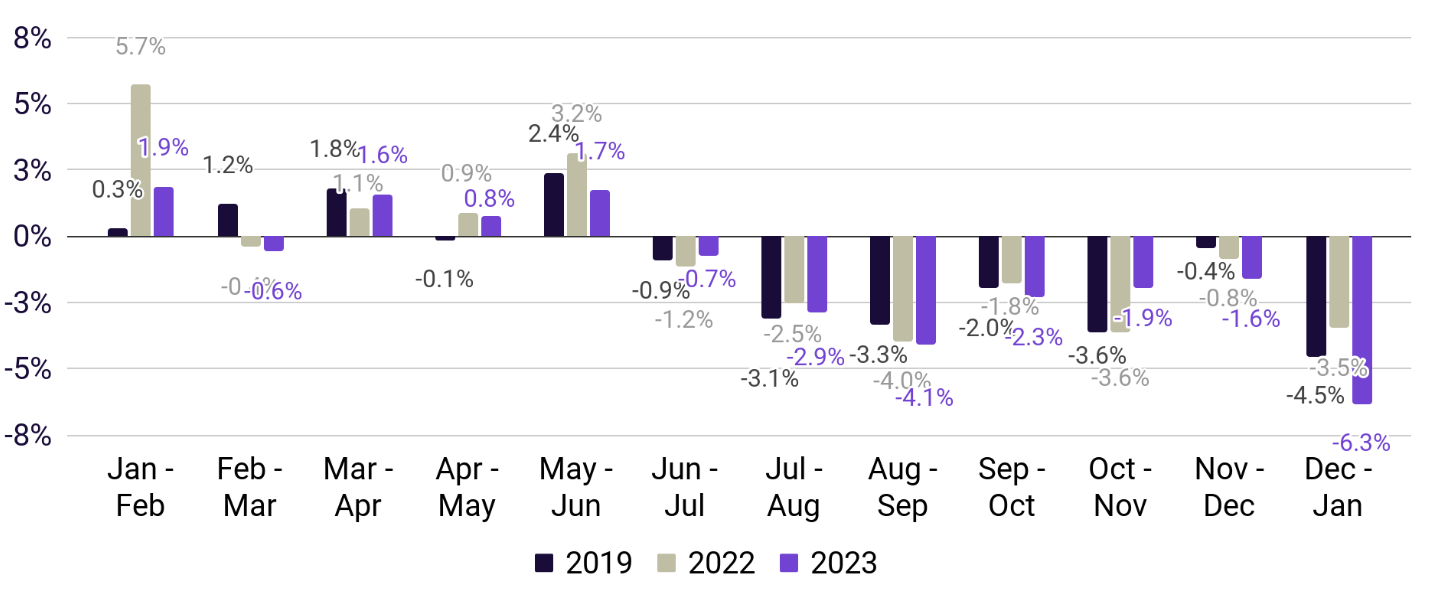

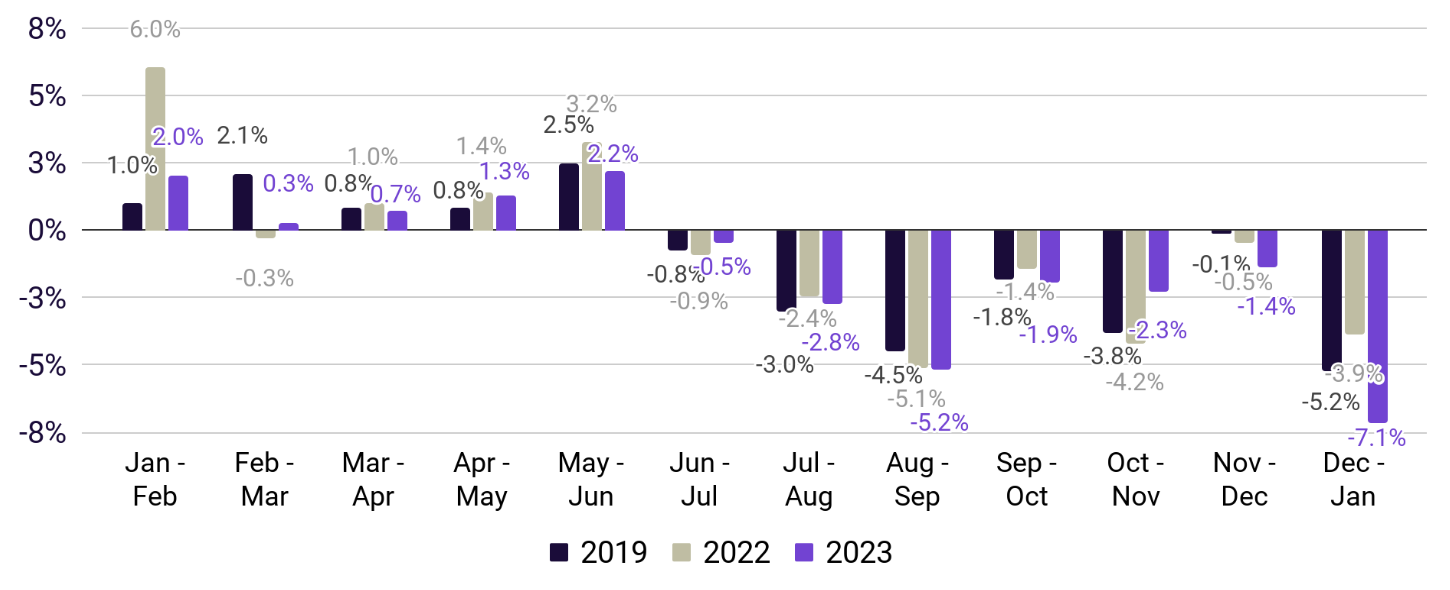

The seasonal slowdown at Main Street businesses post-holidays was more pronounced in 2024 than prior years

Small businesses came down off the holiday bustle more quickly than they have in past years, after a period of prolonged steadiness.

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data compares rolling 7-day averages for weeks encompassing the 12th of each month; April data encompasses the subsequent week to account for Easter holiday. Source: Homebase data.

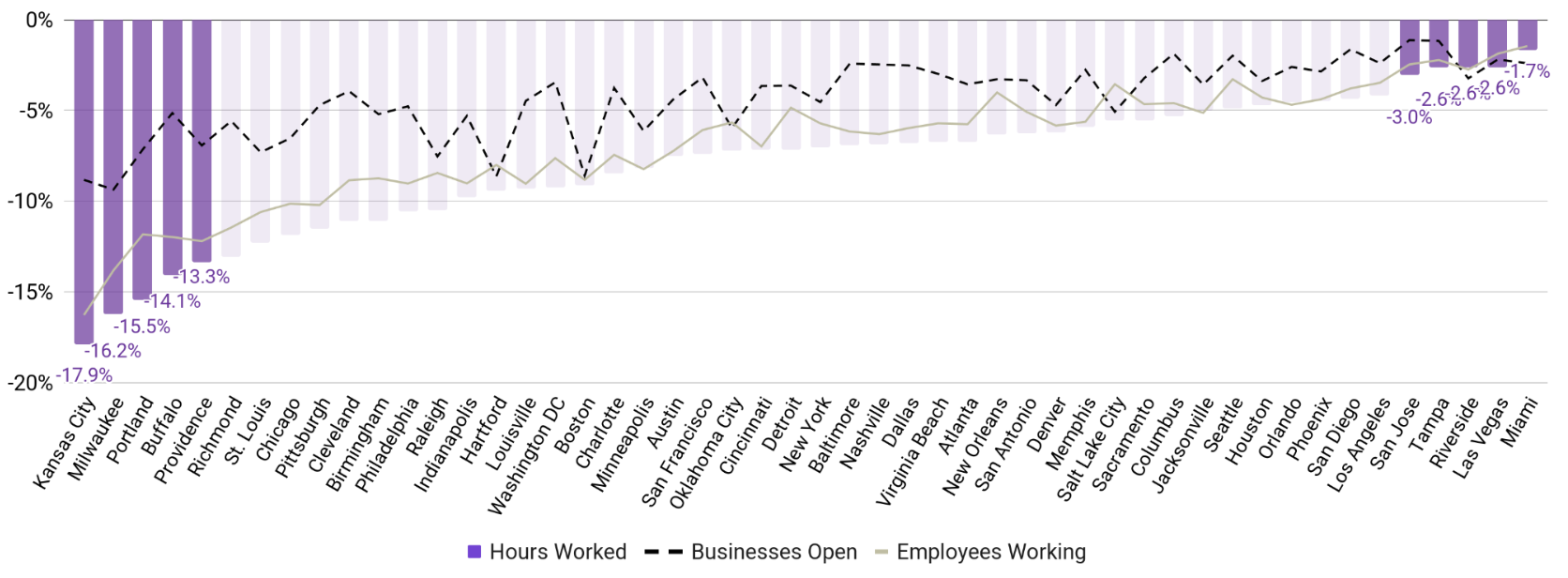

Southern cities maintained economic activity from the holidays

The seasonal decline for SMBs was concentrated in northern areas, specifically the Midwest, where January weather – and thus, consumer demand – was particularly dreary.

Output by MSA

Month-over-month change in core economic indicators, by metropolitan statistical area

Note: December 10-16 vs. January 7-13. Source: Homebase data.

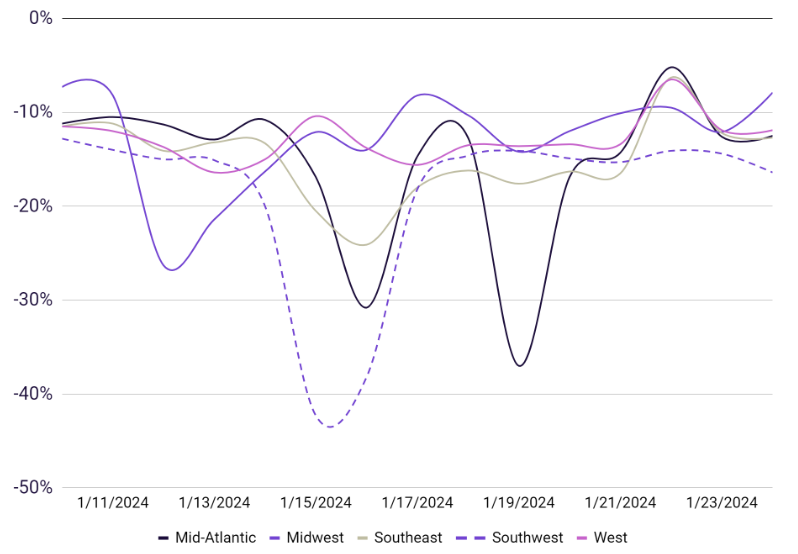

Northern regions feel the new year downswing in demand

The Northeast and Midwest saw the largest drop in activity, as consumers opted to stay home and spend less to start 2024

Output by Region

Month-over-month change in core economic indicators, by Census region

Note: December 10-16 vs. January 7-13. Region classification – Midwest: ND, SD, NE, KS, MN, IA, MO, WI, IL, IN, OH, MI; West: NV, UT, AZ, NM, CO, WY, MT, ID, OR, WA, CA, HI, AK; Northeast: NY, PA, NJ, CT, RI, MA, NH, VT, ME; Southeast: MS, AL, TN, KY, NC, SC, GA, FL; Southwest: TX, OK, AR, LA. Source: Homebase data

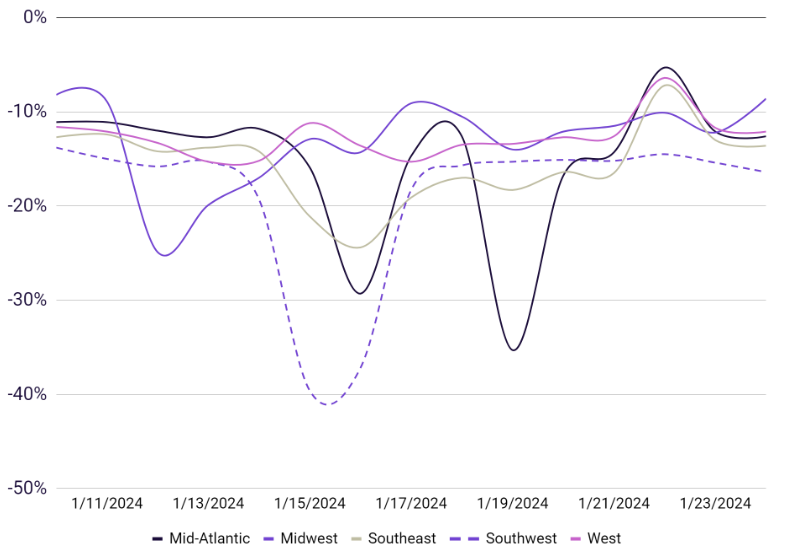

Nationwide deep freeze over MLK Day felt acutely in Southwest

Dangerously cold weather in January hampered business activity in desert states most intensely

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Note: Region classification – Midwest: ND, SD, NE, KS, MN, IA, MO, WI, IL, IN, OH, MI; West: NV, UT, AZ, NM, CO, WY, MT, ID, OR, WA, CA, HI, AK; Northeast: NY, PA, NJ, CT, RI, MA, NH, VT, ME; Southeast: MS, AL, TN, KY, NC, SC, GA, FL; Southwest: TX, OK, AR, LA. Source: Homebase data

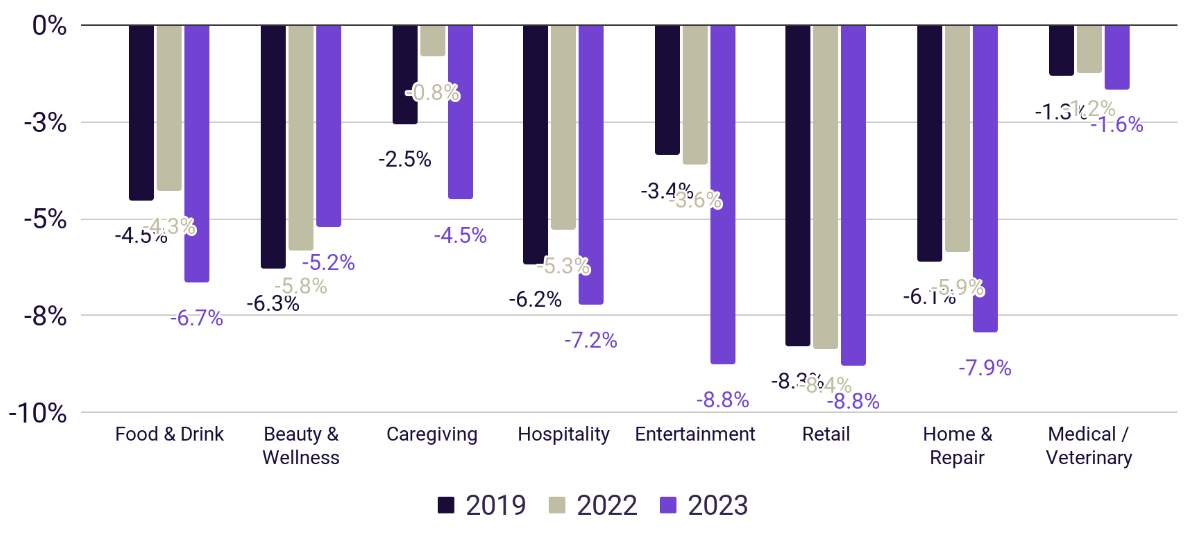

Entertainment and Food & Drink were most impacted by post-holiday slowdown

Two industries most dependent on foot traffic – entertainment (-8.8%) and food & drink (-6.7%) – saw a steeper decline in activity than in years prior

In general, all industries experienced a decline in business activity from pre-Christmas peaks, as the first few weeks of a new year typically precipitate declines in consumer spending and patronization of Main Street businesses.

Percent change in employees working

(Mid-January vs. mid-December, using Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines)

Entertainment includes events/festivals, sports/recreation, parks, movie theaters, and other categories.

December 8-14 vs. January 12-18 (2019/2020); December 11-17 vs. January 8-14 (2022/2023); December 10-16 vs. January 7-13 (2023/2024). Source: Homebase data

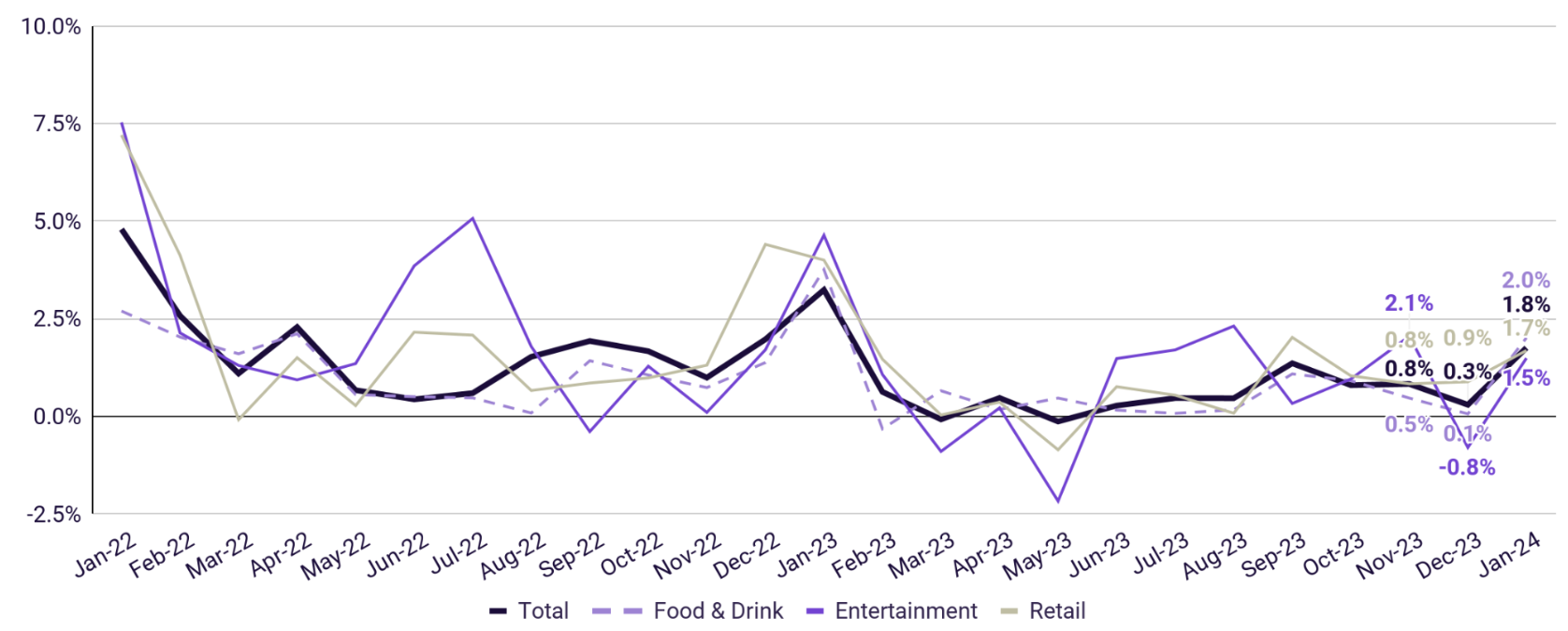

Wages at small businesses rose into the new year

After closing 2023 with steady rates, average employee earnings jumped after the holiday season

Avg. wage changes, m/m

Monthly change in average hourly wages across all jobs

Note: Data measures average hourly wages for locations that utilized Homebase to pay employees in both January 2024 and January 2023. Total includes industries not depicted here. Source: Homebase Payroll data.

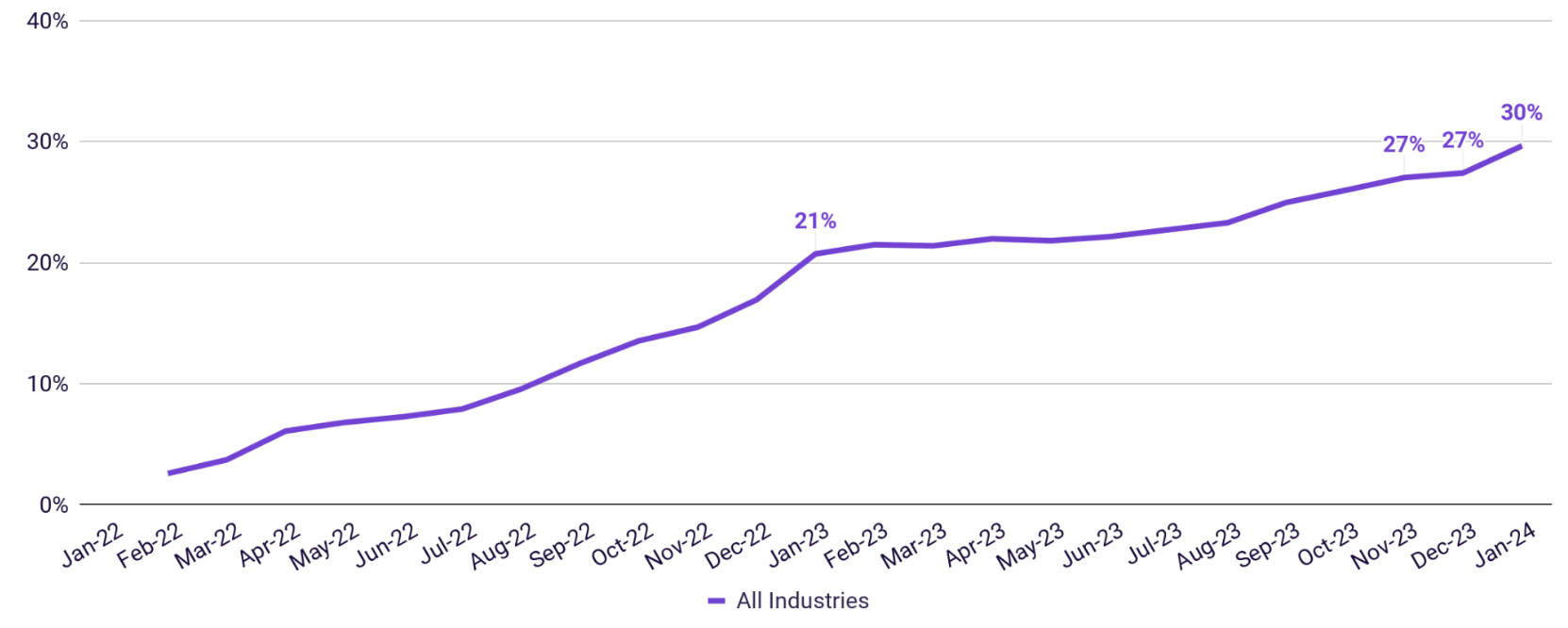

Labor costs are 30% higher than two years ago

SMB owners face elevated costs to staff their businesses compared to January 2022

Avg. hourly wages

Percent change in average hourly wages across all jobs, relative to January 2022

Note: Data measures average hourly wages for locations that utilized Homebase to pay employees in both January 2024 and January 2023. Source: Homebase Payroll data.

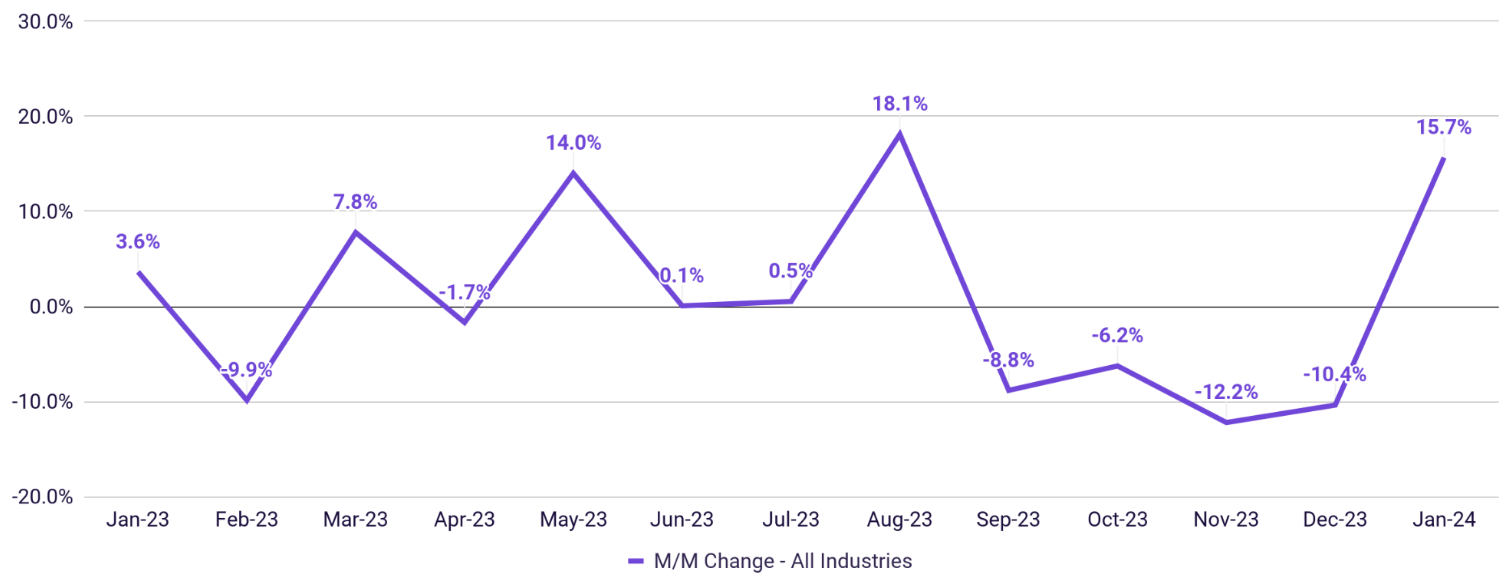

After a steady holiday season, small business owners started the new year with big changes to their rosters

Seasonal workers left their roles at elevated levels in January, leading to a spike in turnover and increased hiring activity at SMBs to begin 2024.

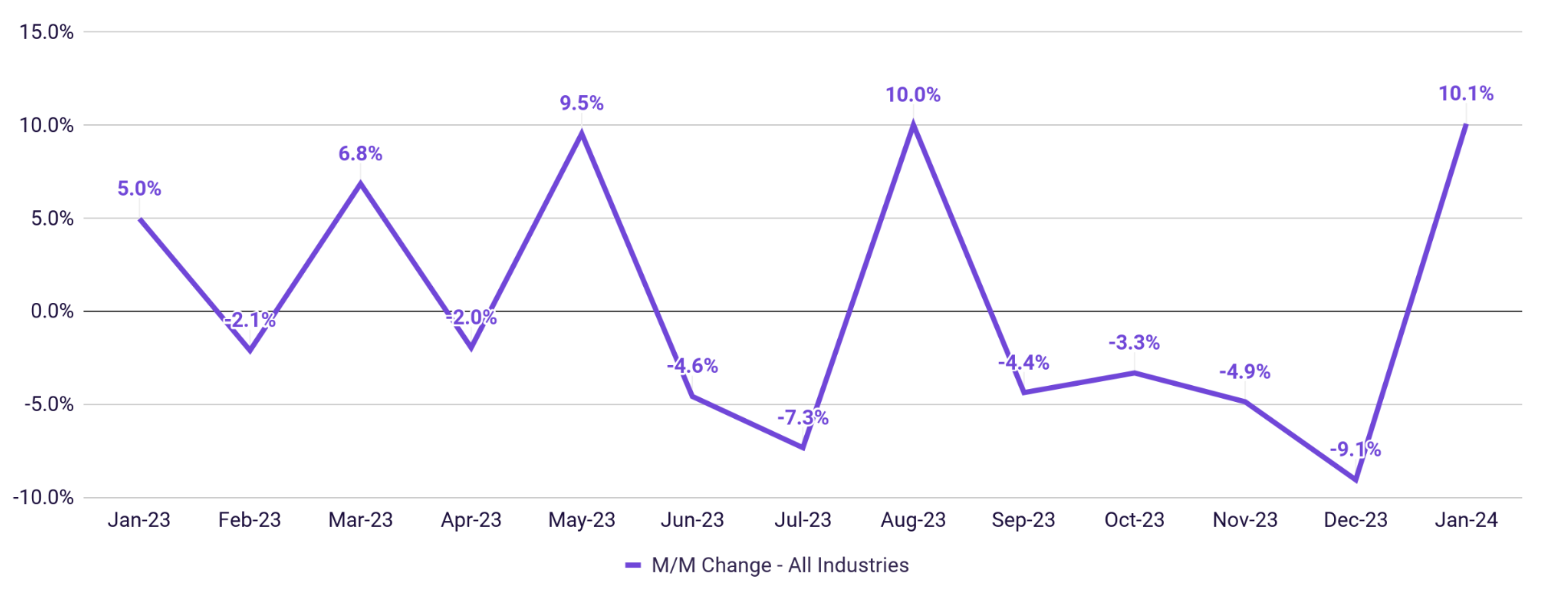

M/M changes in average jobs created

Monthly change in average number of jobs added across all jobs

Note: Data measures average monthly change in total number of jobs created in official employee rosters for companies active in any given month. Source: Homebase data.

M/M changes in average number of jobs removed

Monthly change in average jobs archived across all jobs

Note: Data measures average monthly change in total number of jobs removed, whether by voluntary or involuntary exit, from official employee rosters for companies active in any given month. Source: Homebase data.

View a PDF of our full January 2024 Main Street Health Report. If you choose to use this data for research or reporting purposes, please cite Homebase.