This analysis is by Bloomberg Intelligence Senior Analyst Edmond Christou. It appeared first on the Bloomberg Terminal.

As the oil-rich Gulf region becomes the center of attention for global investors who are attracted by transforming economies and rising construction spending, an oil price of at least $80 a barrel is critical in 2024 for banks to meet liquidity, with the exception of Saudi Arabia, which needs oil at $108. Our takeaways from 4Q earnings suggest that Saudi banks’ loan growth of 10-12% in 2024 is likely to be funded from costlier interest-bearing funds, and any Fed easing in the US would be warranted to ease margin drag and boost activities. UAE banks may see their fortunes turn this year as a new corporate tax, lower margin and normalizing cost of risk make robust returns of 2023 hard to repeat.

Bloomberg Intelligence: Data-driven research

Mind the rates; Shifting economic conditions challenge lenders

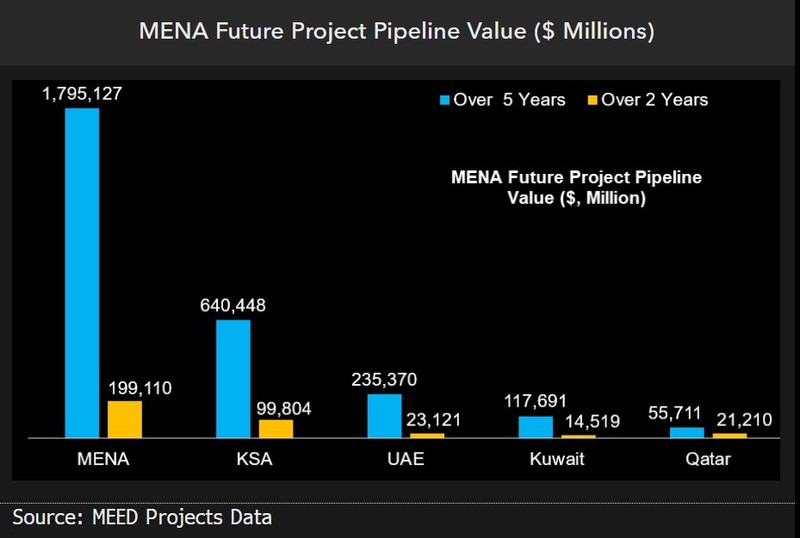

Saudi banks may find 2024 easier to navigate than 2023, helped by a clearer global path toward lower interest rates, which is crucial to support lending and enable them to diversify the funding mix by more debt issuance to support a $640 billion project pipeline over the next five years, per recent data from MEED. UAE banks have performed well since the pandemic, but potential interest-rate cuts in 2H and a new corporate tax could challenge any rerating. Qatari banks’ performance has been weak since September 2022 amid subdued lending activity, margin headwinds and property-market asset-quality concerns. The silver lining for Qatari peers is a gradual cut in rates. A spillover from LNG expansion to the economy is likely to be evident in 2025, along with a recovery in property prices and occupancy rates.

Gulf banks backed by $1.8 trillion investment pipeline

Gulf bank valuations are underpinned by a construction pipeline worth $1.8 trillion over five years, according to MEED’s January’s data. Saudi Arabia leads with $640 billion of project value, followed by the UAE’s $235 billion. Qatar’s list is smaller, with any spillover from liquefied natural gas terminal expansion likely yet to be captured. Construction spending may allow UAE banks’ wholesale credit to achieve a compounded annual growth rate of 5-7% over five years, assuming a 50-70% utilization rate, or 2-4% at 20-40%. Saudi corporate loans could rise at 12-15% CAGR in five years for a credit utilization above 50%, or 5-10% at 20-40%.

Fed policy easing is key for banks to gather cheaper dollar deposits to fund a large project pipeline. Higher-for-longer rates reduce historical utilization.

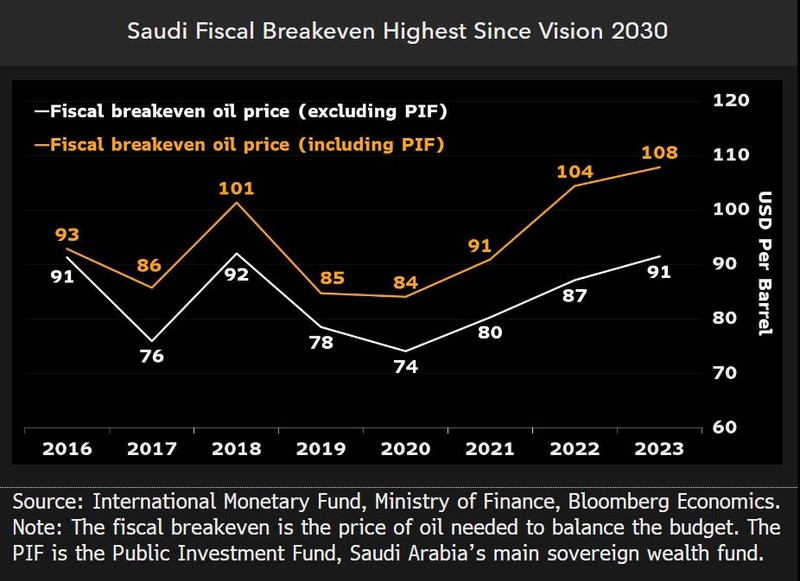

Saudi Arabia’s oil breakeven at $108 means tight supply in 2024

Saudi Arabia wants to diversify its economy, but the government is still addicted to high oil prices. It needs crude at $108 per barrel to balance its budget and meet its sovereign wealth fund’s domestic spending. The figure is the highest since 2016, when it released Vision 2030.

Public spending is the main reason behind the rise in the budget’s dependence on oil. Expenditure has risen by $111 billion between 2016 and 2023. Including the sovereign wealth fund’s domestic investments, the spending increase amounts to $148 billion. Bigger outlays need higher oil prices to fund them. Click the Text tab for the full report.